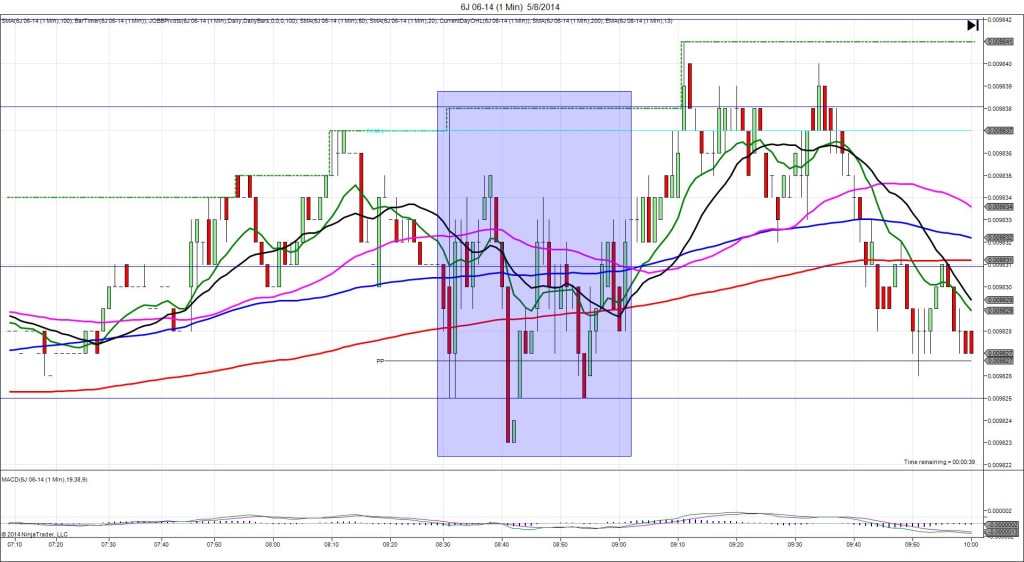

5/8/2014 Weekly Unemployment Claims (0830 EDT)

Forecast: 328K

Actual: 319K

TRAP TRADE

Anchor Point @ 0.009831 (last price)

————

Trap Trade:

)))1st Peak @ 0.009838 – 0830:00 (1 min)

)))7 ticks

)))Reversal to 0.009825 – 0830:03 (1 min)

)))-13 ticks

————

Trap Trade Bracket setup:

Long entries – 0.009822 (no SMA / Pivot near) / 0.009811 (just above the LOD)

Short entries – 0.009839 (just above the R1 Mid Pivot/HOD) / 0.009849 (just above the R1 Pivot)

Notes: Report came in moderately strong with 9K less jobs lost than the forecast with no other significant statistical news. This caused a 7 tick long unsustainable spike in 1 sec that rose to cross the R1 Mid Pivot and OOD, then immediately fell back to the origin. This would have just missed your inner short entry tier, but the setup was perfect as it quickly retreated. It continued to chop up and down as the ECB Press conference progressed and impacted after about 2 min.