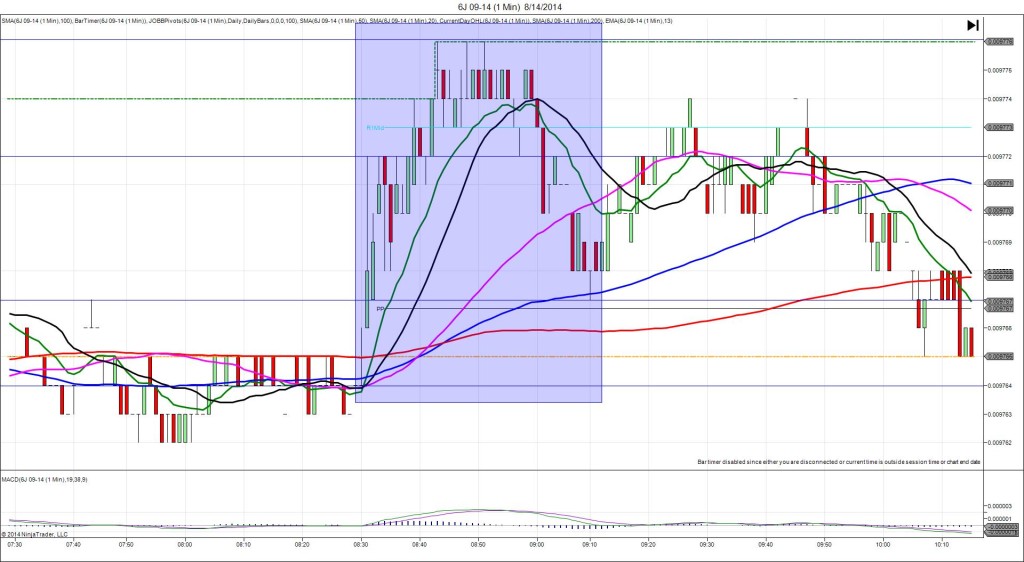

7/17/2014 Weekly Unemployment Claims (0830 EDT)

Forecast: 310K

Actual: 302K

TRAP TRADE (DULL -NO FILL)

Anchor Point @ 0.009854 (last price)

————

Trap Trade:

)))1st Peak @ 0.009862 – 0830:02 (1 min)

)))8 ticks

)))Reversal to 0.009858 – 0834:27 (5 min)

)))-4 ticks

————

Trap Trade Bracket setup:

Long entries – 0.009846 (just below the R2 Mid Pivot) / 0.009834 (just below the PP Pivot)

Short entries – 0.009864 (just below the R3 Pivot) / 0.009874 (just above the R4 Mid Pivot)

Notes: Report came in impressive with 10k less jobs lost than the forecast. Building Permits / Housing Starts were released at the same time and came in disappointing. This caused an 8 tick long spike that crossed all 3 Major SMAs and the R3 Mid Pivot. The move would have probably missed the inner tier short order by 1 or 2 ticks, so cancel the order. After the spike it took over 4 min to reverse for a meager 4 ticks, so if you have been filled, you would have had an opportunity to exit between 1 and 4 ticks. After that it was tame and traded sideways.