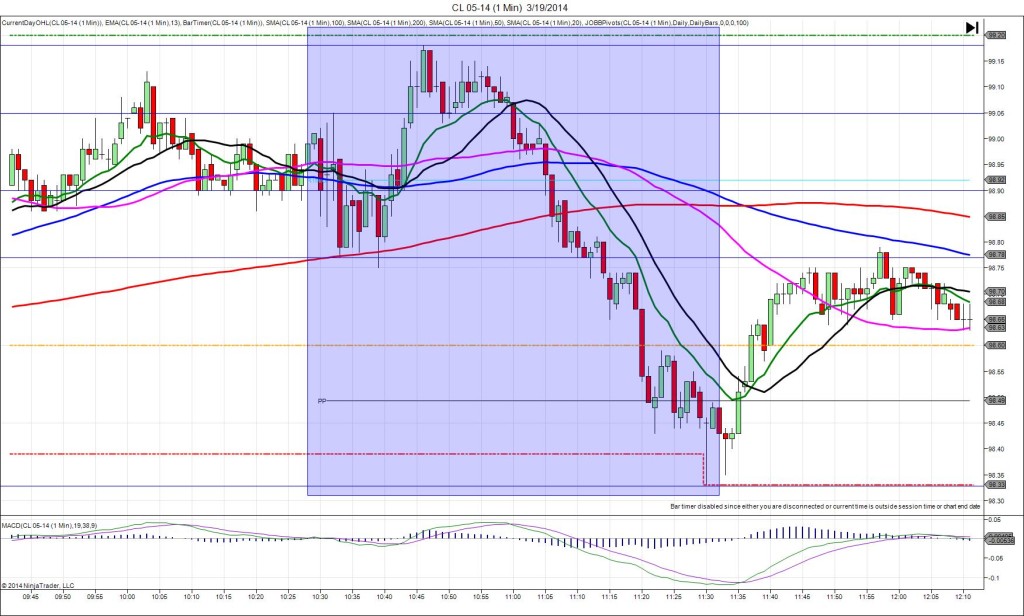

3/20/2014 Weekly Unemployment Claims (0830 EDT)

Forecast: 327K

Actual: 320K

TRAP TRADE (DULL REACTION)

Anchor Point @ 0.009772 (last price)

————

Trap Trade:

0831 bar span 0.009771 – 0.009768 (1 min)

3 ticks

————

Trap Trade Bracket setup:

Long entries – 0.009764 (just below the 100 SMA) / 0.009754 (just below the LOD)

Short entries – 0.009781 (no SMA/Pivot near) / 0.009790 (just above the HOD)

Notes: Report came in strong but close to the forecast with 7K less jobs than the forecast with no other news. This caused a dull 0831 bar of only 3 ticks movement on the OOD and 13 SMA. Cancel the order with no impulse after 20 sec. It eventually drifted a few ticks down to hit the 200 SMA, then bounced for about 10 ticks in 9 min.