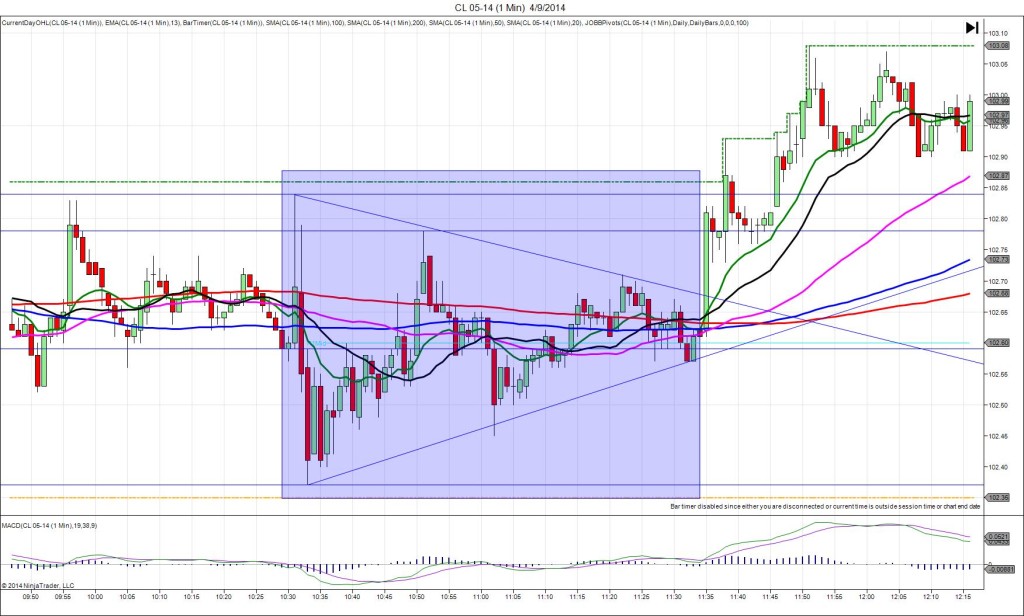

4/9/2014 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: 1.33M

Actual: 4.03M

Gasoline

Forecast: -0.73M

Actual: -5.19M

Distillates

Forecast: -0.09M

Actual: 0.24M

SPIKE / REVERSE

Started @ 102.59

1st Peak @ 102.84 – 1030:08 (1 min)

25 ticks

Reversal to 102.37 – 1033 (3 min)

47 ticks

Pullback to 102.78 – 1051 (21 min)

28 ticks

Reversal to 102.45 – 1102 (32 min)

33 ticks

Notes: Moderate gain in inventories when a modest gain was expected, while gasoline saw a large draw when a negligible draw was expected, and distillates saw a negligible gain when a minimal change was expected. The mixed news caused a long unsustainable spike of 25 ticks 8 sec into the :31 bar as it hit a double top and nearly reached the HOD. With JOBB and a 10 tick buffer, you would have filled long at 102.71 with 2 ticks of slippage, then had an opportunity to exit with up to 12 ticks with a profit target or 6 ticks manually up to 41 sec into the :31 bar. After that it reversed for 47 ticks in the next 2 bars, nearly reaching the OOD. Then we saw a pullback of 28 ticks in 18 min, followed by a reversal of 33 ticks in 11 min. Again the swings are common presenting several opportunities for good trades after the report for about an hour. Notice how it burst out of the triangle long at 1135 for a sizable reaction.