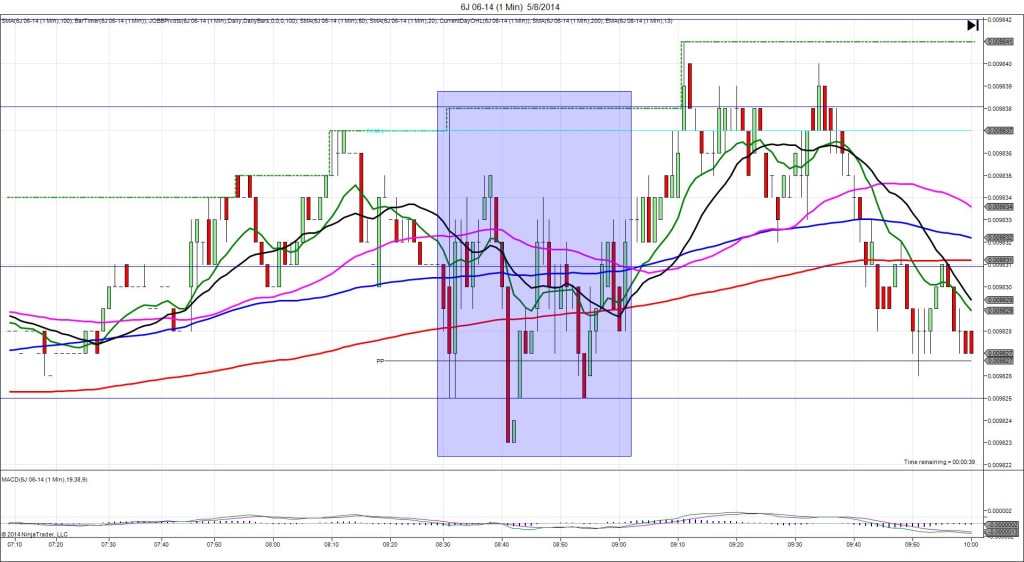

5/6/2014 Monthly Trade Balance (0830 EDT)

Forecast: -40.1B

Actual: -40.4B

Previous Revision: +0.4B to -41.9B

DULL REACTION

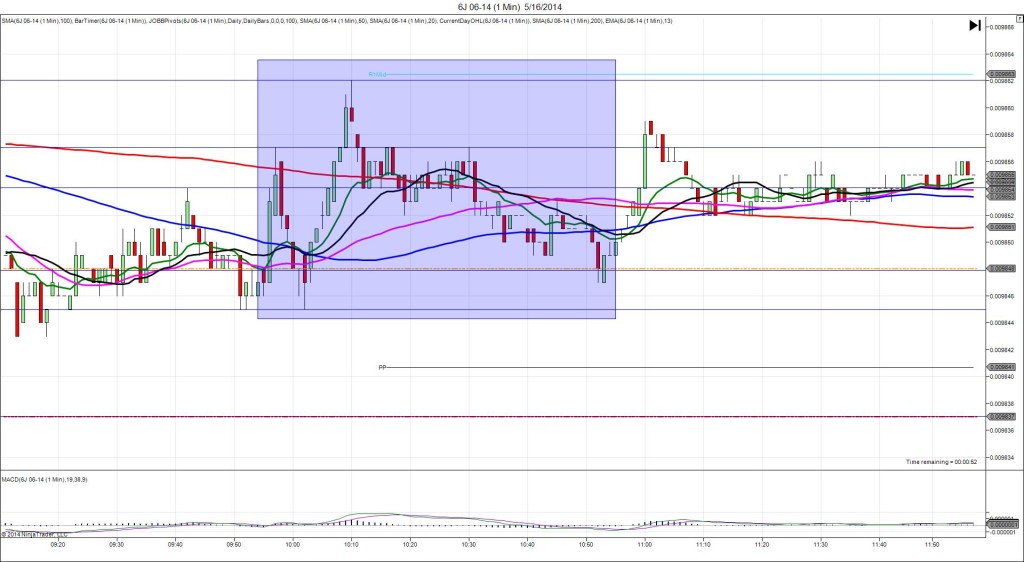

Started @ 0.009842

1st Peak @ 0.009845 – 0831 (1 min)

3 ticks

2nd Peak @ 0.009851 – 0842 (12 min)

9 ticks

Reversal to 0.009841 – 0851 (21 min)

10 ticks

Notes: Report nearly matched the forecast to cause a dull long reaction that only achieved 3 ticks on the :31 bar to reach the HOD then backed off. With JOBB you would have either cancelled after 10 sec with no fill or been filled at 0.009845 with no slippage, then seen it back off and hover at -1 tick for about 30 sec. Look to exit there with the matching results. After the :31 bar, it climbed for a 2nd peak of 6 more ticks in 11 min. Then it fell 10 ticks in the next 9 min back to the R3 Mid Pivot. After that it traded sideways.