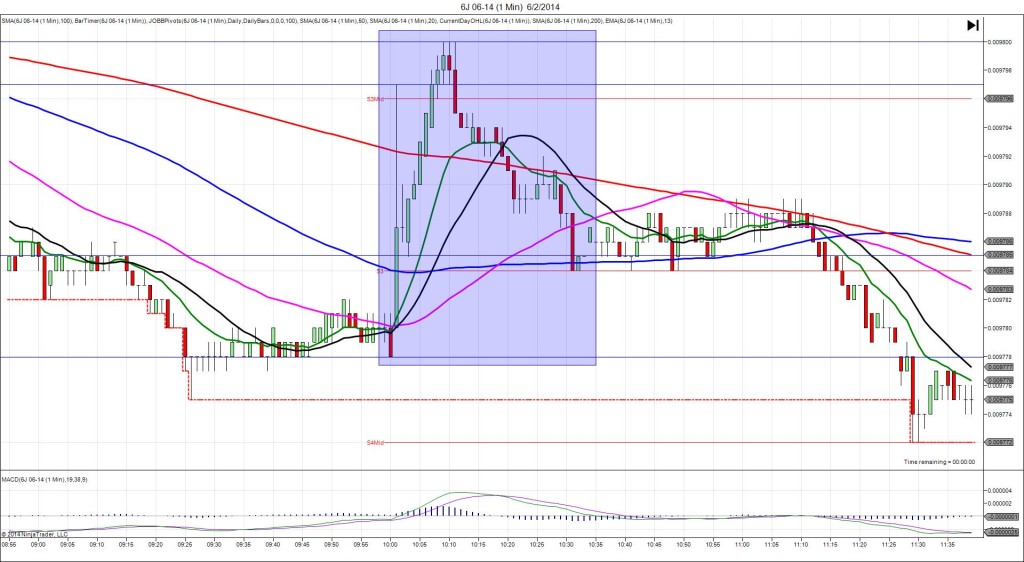

6/2/2014 Monthly ISM Manufacturing PMI (1000 EDT)

Forecast: 55.7

Actual: 53.2* corrected to 55.4 150 min later

Previous revision: n/a

SPIKE WITH 2ND PEAK

Started @ 0.009778

1st Peak @ 0.009797 – 1000:00 (1 min)

19 ticks

Reversal to 0.009785 – 1003 (3 min)

12 ticks

2nd Peak @ 0.009800 – 1009 (9 min)

22 ticks

Reversal to 0.009784 – 1031 (31 min)

16 ticks

Notes: Report came in initially erroneously disappointing with an offset of 2.5 pts. It was later corrected 150 min later to 56.0, then revised again to 55.4 to be narrowly missing. Even though the correct reading is 55.4, the market reaction was based on 53.2. This caused a large, quick, and shortly sustained bullish reaction followed by a quick reversal. We saw a long spike of 19 ticks on the :01 bar that started just below the 50 SMA then rose to cross all 3 major SMAs and the S3 Mid Pivot. With JOBB, you would have filled long at 009793 with abnormally high 11 ticks of slippage, then seen it briefly hover between breakeven and 2 ticks of profit before falling in the next 10 sec to hit your stop if you did not manually exit earlier closer to breakeven. Regardless of the outcome, the quick reversal with a strong deviation presented an excellent opportunity to buy it around 0.009786 for a 2nd peak climb. That would have yielded up to 15 ticks in about 6 min. Then it reversed again for 16 ticks back to the S3 Pivot after 22 min.