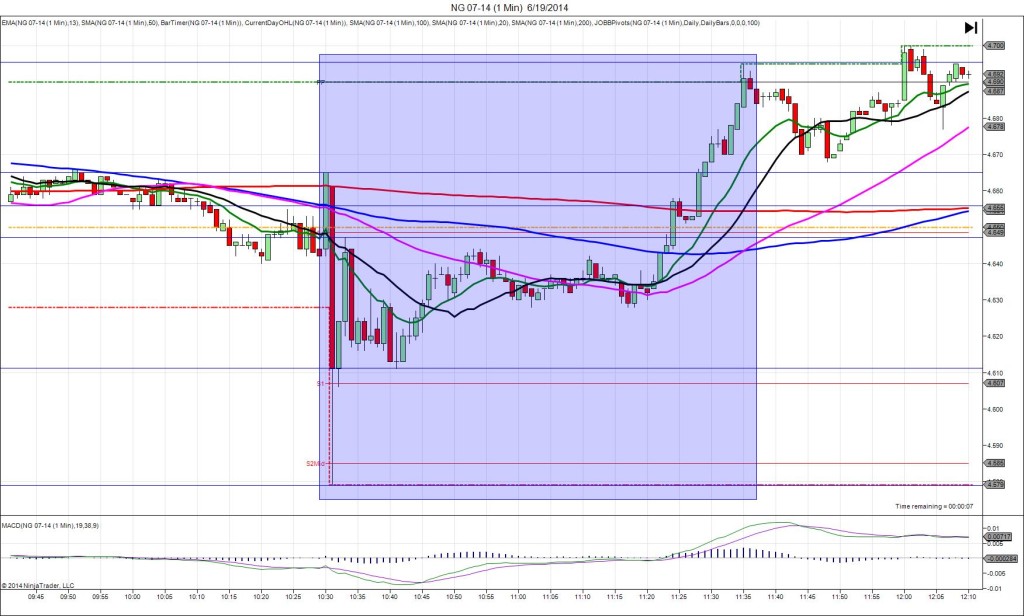

6/12/2014 Weekly Natural Gas Storage Report (1030 EDT)

Forecast: 111B

Actual: 107B

SPIKE WITH 2ND PEAK

Started @ 4.544

1st Peak @ 4.683 – 1032:58 (3 min)

139 ticks

Reversal to 4.656 – 1036 (6 min)

27 ticks

2nd Peak @ 4.708 – 1049 (19 min)

164 ticks

Reversal to 4.677 – 1100 (30 min)

31 ticks

Notes: We saw a slightly smaller gain on the reserve compared to the forecast which caused a large long spike that continued to progressively climb. The spike started on the tightly clustered 3 Major SMAs and rose to cross the R3 Mid Pivot on the :31 bar, and the R3 Pivot on the :33 bar for a total of 139 ticks. With JOBB, you would have filled long at about 4.579 with about 25 ticks of slippage, then seen it continue to ratchet higher without much of a retreat until about 3 min after the report. This would have allowed an exit of up to 100 ticks. After that it fell 27 ticks in the next 3 min, then climbed for a 2nd peak of 25 more ticks after 13 min to the R4 Mid Pivot. Then it fell 31 ticks in the next 11 min and traded sideways.