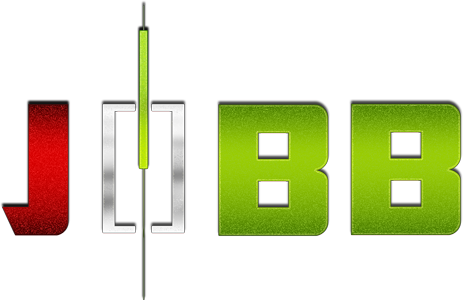

7/10/2014 30-yr Bond Auction (1301 EDT)

Previous: 3.44/2.7

Actual: 3.37/2.4

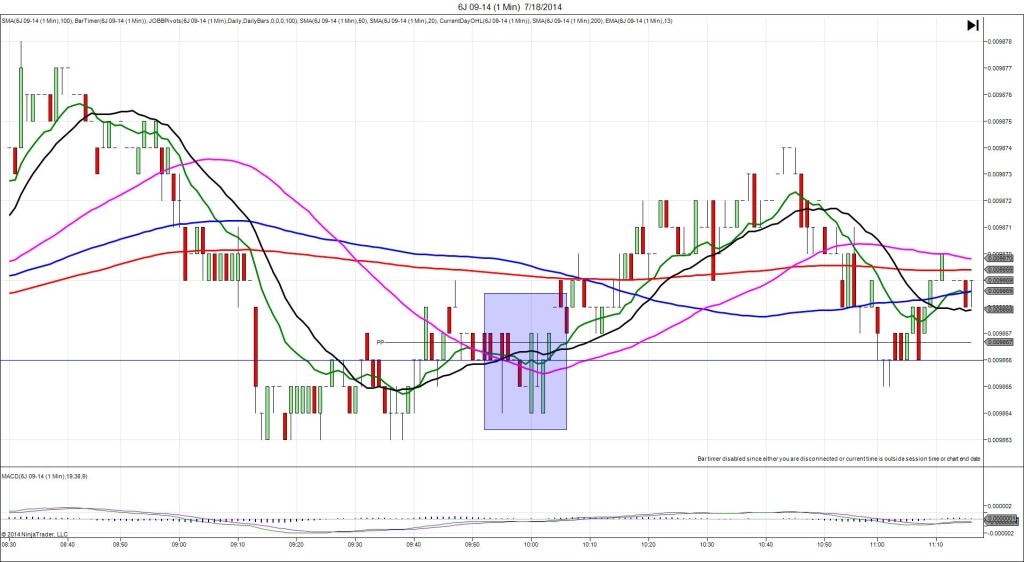

SPIKE WITH 2ND PEAK

Started @ 137’08 (1301)

1st Peak @ 137’02 – 1302 (1 min)

6 ticks

Reversal to 137’07 – 1303 (2 min)

5 ticks

Final Peak @ 136’29 – 1342 (41 min)

11 ticks

Reversal to 137’04 – 1353 (52 min)

7 ticks

Notes: Report is scheduled on Forex Factory at the bottom of the hour, but the spike always breaks 1 min late. The highest yield fell slightly from last month, but the demand fell off a bit. This caused the bonds to spike short for a small reaction of 6 ticks that started on the R1 Pivot and 100/50 SMAs, then fell. With JOBB you would have filled short at 137’05 with no slippage, then seen it hover between your fill point and +2 ticks for about 30 sec. You could have exited there, or waited for the secondary drop which fell nicely after 10 min to the R1 Mid pivot for another 2 ticks beyond the 1st peak allowing up to 4-5 ticks to be captured. Then the final peak fell another 3 ticks after another 30 min. after that it reversed for 7 ticks in 11 min to the 100 SMA.