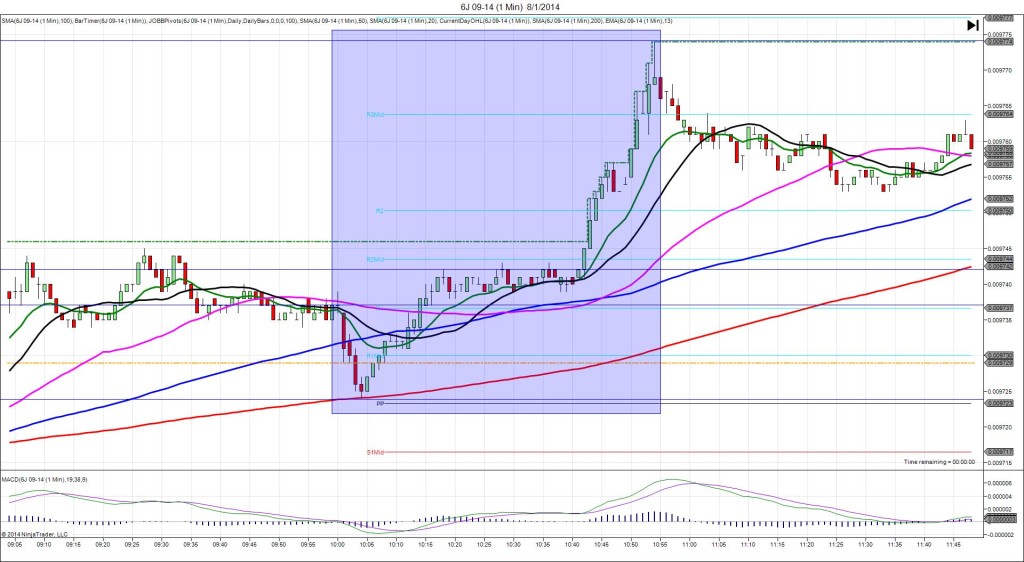

8/6/2014 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: -1.71M

Actual: -1.76M

Gasoline

Forecast: 0.30M

Actual: -4.39M

Distillates

Forecast: 0.88M

Actual: -1.80M

SPIKE WITH 2ND PEAK

Started @ 97.88

1st Peak @ 97.65 – 1030:25 (1 min)

33 ticks

Reversal to 98.10 – 1036 (6 min)

45 ticks

Pullback to 97.72 – 1043 (13 min)

38 ticks

Reversal to 98.13 – 1103 (33 min)

41 ticks

Final Peak @ 97.19 – 1200 (90 min)

69 ticks

Reversal to 102.67 – 1221 (111 min)

67 ticks

Notes: Matching draw in inventories, while gasoline saw a healthy draw when a negligible gain was expected, and distillates saw a modest draw when a modest gain was expected. The large draw in gas should have taken the lead to drive a large spike, but we saw a long head fake then a short move of 33 ticks that hit the 200 SMA. With JOBB and a 10 tick buffer, you would have avoided the long head fake by 1 tick, then filled short at 97.78 with no slippage. It fell to the 200 SMA quickly then hovered for over 30 sec. Look to exit with about 10 ticks. After that it reversed for 45 ticks in the next 5 min, then fell back to the 200 SMA in the next 7 min. Then it reversed to the HOD in the next 20 min. Finally it fell slowly and methodically for a final peak of 36 more ticks to the S1 Mid Pivot in the next hour. With the Crude matching, we saw a very strange reaction.