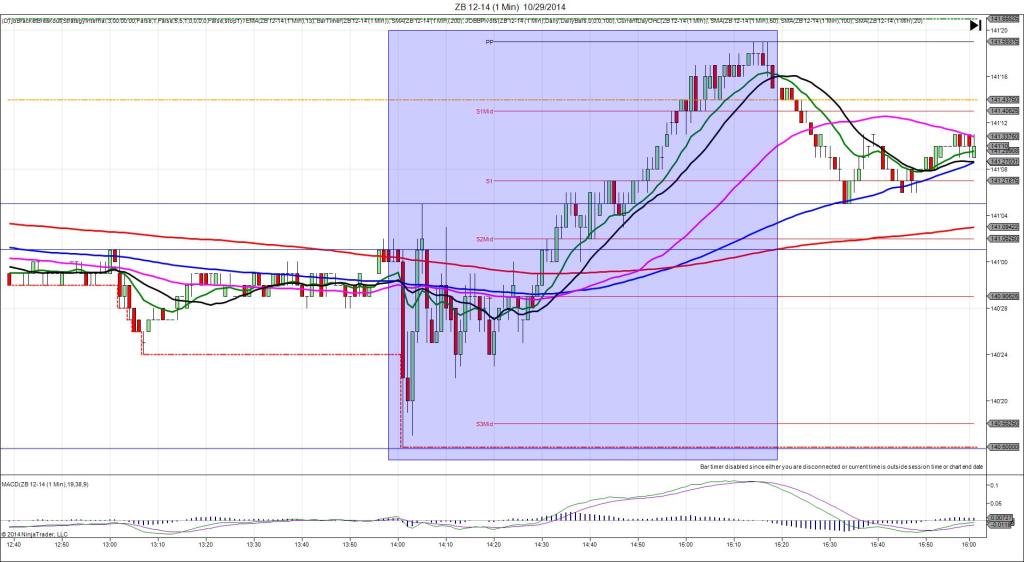

10/23/2014 Weekly Unemployment Claims (0830 EDT)

Forecast: 269K

Actual: 283K

TRAP TRADE – DULL NO FILL

Anchor Point @ 0.009288

————

Trap Trade:

)))1st Peak @ 0.009282 – 0830:57 (1 min)

)))-6 ticks

)))Reversal to 0.009286 – 0831:24 (2 min)

)))4 ticks

————

Trap Trade Bracket setup:

Long entries – 0.009280 (just below the S3 Pivot) / 0.009269 (No SMA /Pivot near)

Short entries – 0.009297 (in between the 100/50 SMAs) / 0.009307 (just below the S2 Mid Pivot)

Notes: Report came in moderately weak with 14k offset. This caused a slow short spike of only 6 ticks that started on the falling 13 SMA and fell to cross the S3 Mid Pivot and extend the LOD. This would have been an obvious scenario to cancel the order on the slow movement and small reaction. After peaking near the end of the bar, it reversed only 4 ticks in the next 27 sec, then traded sideways around the S3 Mid Pivot.