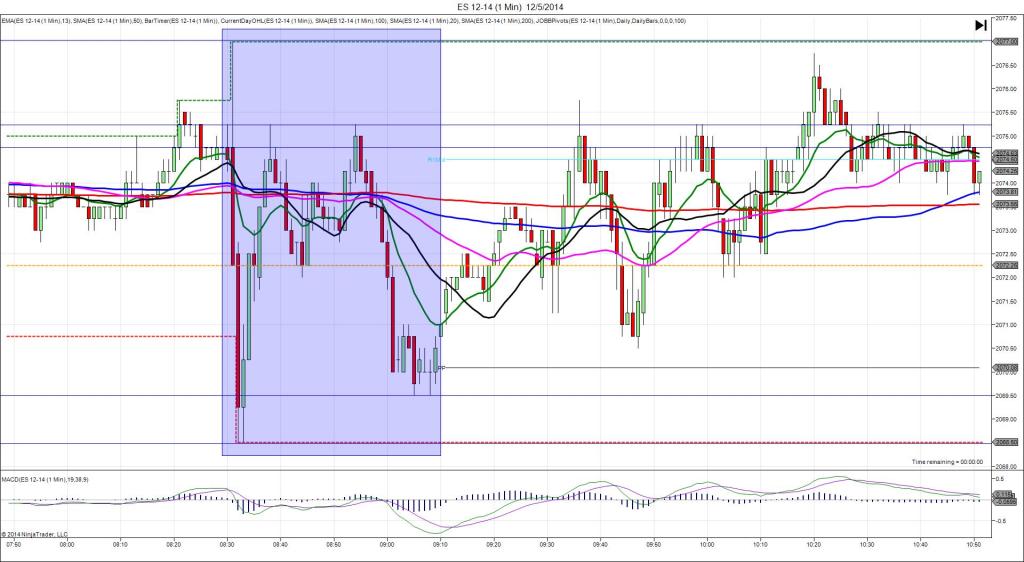

11/14/2014 Prelim UoM Consumer Sentiment (0955 EDT)

Forecast: 87.3

Actual: 89.4

TRAP TRADE – DULL NO FILL

Anchor Point @ 0.0008577 (last price)

————

Trap Trade:

)))1st Peak @ 0.008570 – 0956:52 (2 min)

)))-7 ticks

)))Reversal to 0.008575 – 0957:38 (3 min)

)))5 ticks

————

Continued Reversal to 0.008603 – 1007 (12 min)

33 ticks

Pullback to 0.008587 – 1011 (16 min)

16 ticks

Trap Trade Bracket setup:

Long entries – 0.008572 (just below the S3 Pivot) / 0.008561 (on the LOD)

Short entries – 0.008583 (just above the 200 SMA) / 0.008593 (on the S3 Mid Pivot)

Notes: Report came in higher than the forecast by 2.1 points causing a slow 7 tick short spike after nearly 2 min as it crossed the S3 Pivot. Since it only moved 4 ticks initially then retreated 2 ticks, do not look for a manual entry and cancel the order after 20 sec. After peaking it reversed 5 ticks in about 45 sec, then another 28 ticks in 9 min as it crossed the S3 Mid Pivot. Then it pulled back 16 ticks in the next 4 min to the 13 SMA and traded sideways.