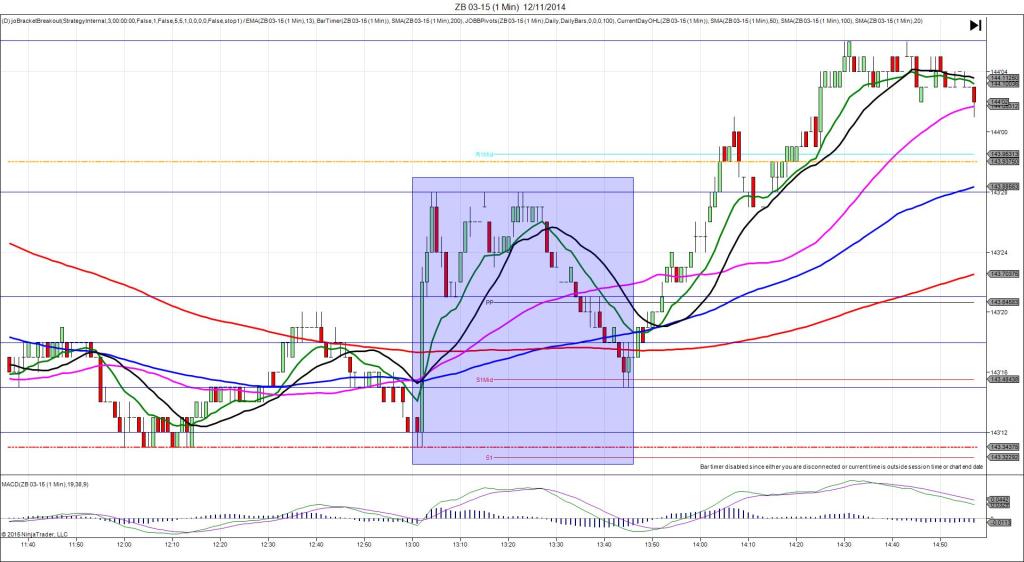

Caption for 12/1:

12/1/2014 Monthly ISM Manufacturing PMI (1000 EST)

Forecast: 57.9

Actual: 58.7

Previous revision: n/a

DULL REACTION – FILL

Started @ 0.008480

1st Peak @ 0.008486 – 1000:09 (1 min)

6 ticks

Reversal to 0.008472 – 1003 (3 min)

14 ticks

Continued Reversal to 0.008458 – 1014 (14 min)

28 ticks

Notes: Report exceeded the forecast with a deviation of 0.8 pts. This caused minimal choppy movement in the first 8 sec before finally resulting in a 6 tick long spike. You may have cancelled the order, but if not with JOBB, you would have filled long at 0.008484 with no slippage, then look to exit at breakeven as it hovered there for 10 sec before drifting lower. After that it reversed 14 ticks in 2 min as it crossed the 20 SMA. Then it fell another 14 ticks in the next 11 min after crossing the 50/100 SMAs.