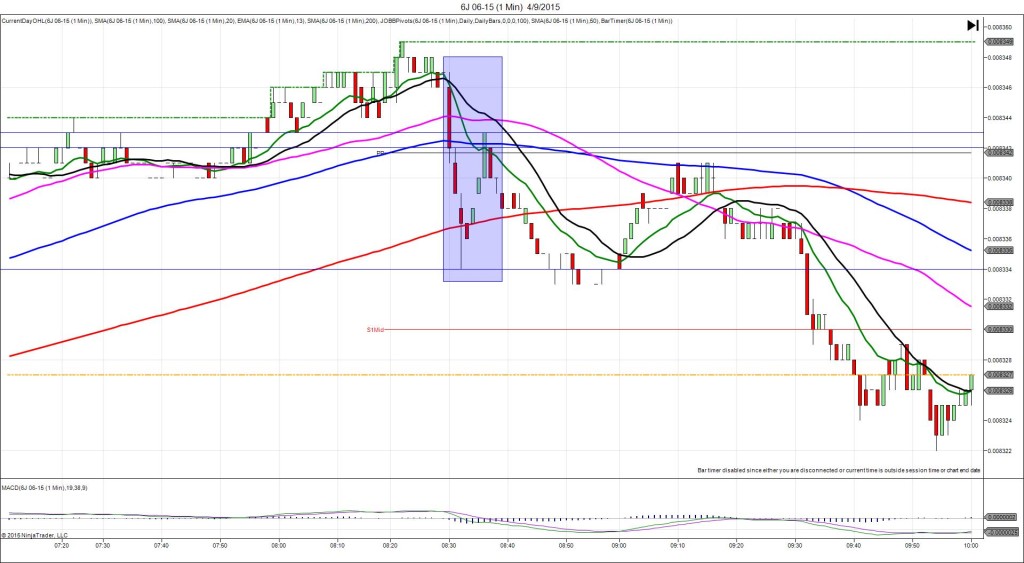

4/9/2015 World Agriculture Supply and Demand Estimates (WASDE) – Soybeans (1200 EDT)

Forecast: n/a

Actual: n/a

SPIKE / REVERSE

Started @ 954.25 (1200:32)

1st Peak @ 950.25 – 1200:33 (1 min)

16 ticks

Reversal to 957.25 – 1201:57 (2 min)

28 ticks

Pullback to 952.50 – 1203 (3 min)

19 ticks

Reversal to 958.00 – 1207 (7 min)

22 ticks

Notes: With the beans, we recommend a delayed setup at 32 sec. In this case the initial reaction would have been tame and safe to trade, but the alternate worked too. As usual, it would have been fairly tame as it hovered around the S4 Mid Pivot to provide an anchor point at 954.25 at 32 sec. With JOBB, your short entry would have filled at 952.50 with 1 tick of slippage, then you would have seen it fall and immediately hover for 6-8 ticks to be captures just above the S4 Pivot. Since this is a strong barrier, look to exit when it shows evidence of stalling. The move was also in line with the original move, so we expect a lower yield. After that it reversed 28 ticks in 1 min to the 50 SMA / S3 Pivot before pulling back 19 ticks in 1 min. Then it reversed 22 ticks in 4 min to the S3 Pivot / 100 SMA.