5/28/2015 Weekly Crude Oil Inventory Report (1100 EDT)

Forecast: -0.86M

Actual: -2.80M

Gasoline

Forecast: -0.43M

Actual: -3.31M

Distillates

Forecast: -0.32M

Actual: 1.12M

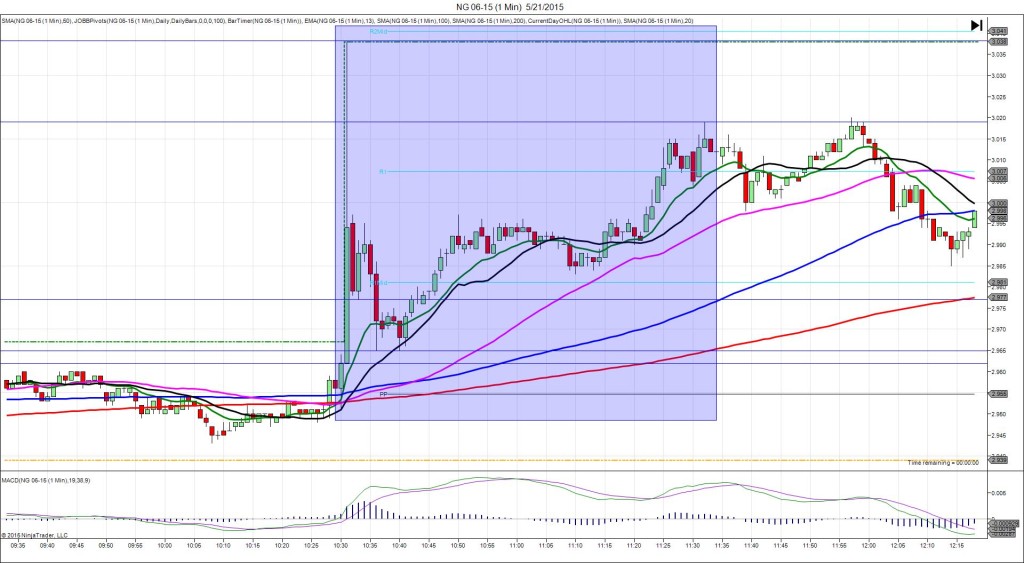

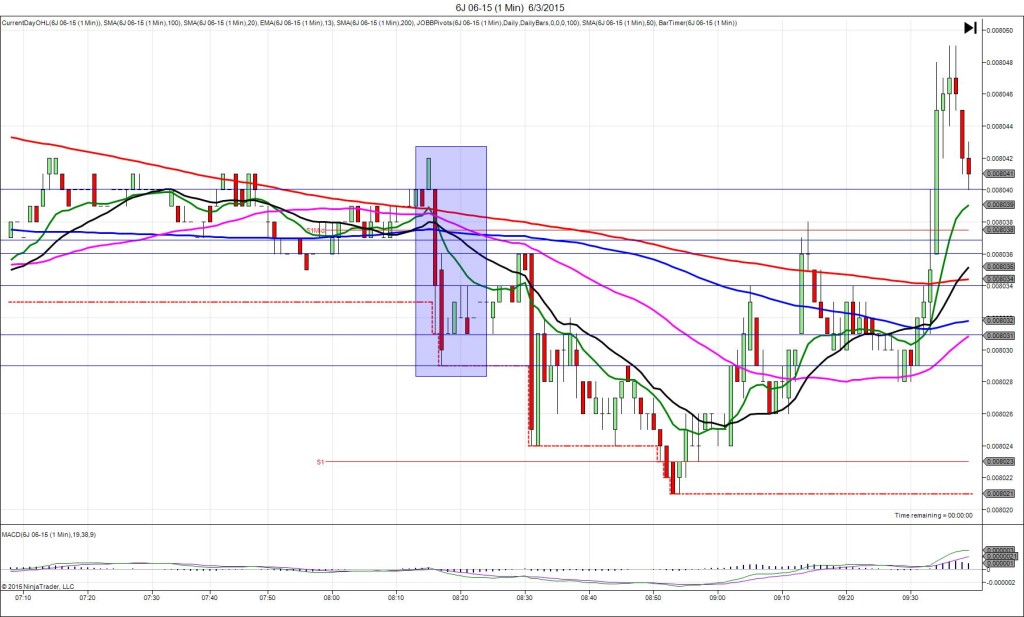

SPIKE WITH 2ND PEAK

Started @ 56.66

1st Peak @ 57.30 – 1100:00 (1 min)

64 ticks

Reversal to 56.81 – 1104 (4 min)

49 ticks

2nd Peak @ 57.44 – 1133 (33 min)

78 ticks

Reversal to 56.85 – 1202 (62 min)

59 ticks

Notes: Moderate draw in inventories when a negligible draw was expected, while gasoline saw a moderate draw when a negligible draw was expected, and distillates saw a modest gain when a negligible draw was expected. This caused a long spike of 64 ticks that started on the 20 SMA and rose to cross the 200 SMA and S1 Pivot in 1 sec. Then it backed off and oscillated between 56.90 and the S1 Pivot for 2 min and eventually reversed to the 50/100 SMAs and S2 Pivot. With JOBB and a 10 tick bracket, your long order would have filled at 56.81 with 5 ticks of slippage. Then it would have peaked and backed off to hover in the vicinity of the 200 SMA for 12 sec. Look to exit there with about 25-30 ticks. After the reversal, it rebounded for a 2nd peak of 14 more ticks in 29 min. Then it reversed 59 ticks in 29 min to nearly reach the S2 Pivot.