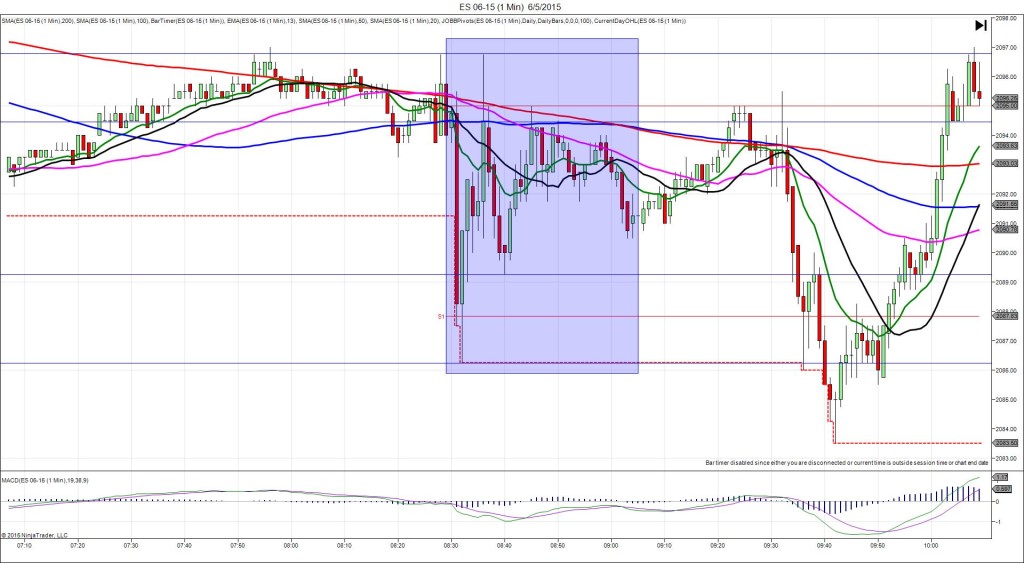

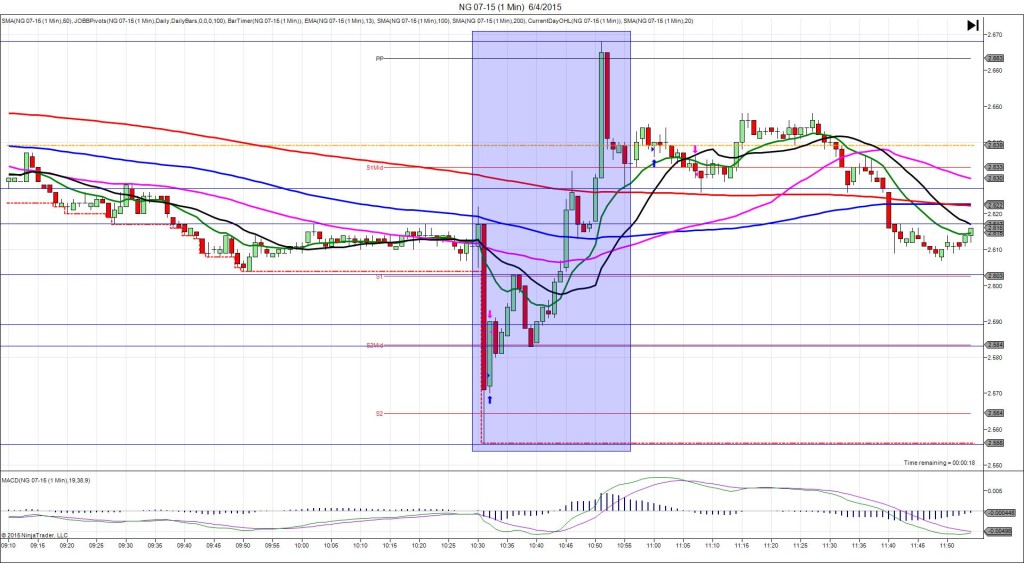

6/3/2015 Monthly ISM Non-Manufacturing PMI (1000 EDT)

Forecast: 57.1

Actual: 55.7

Previous Revision: n/a

SPIKE WITH 2ND PEAK

Started @ 0.008044

1st Peak @ 0.008060 – 1000:43 (1 min)

16 ticks

Reversal to 0.008054 – 1003 (3 min)

6 ticks

2nd Peak @ 0.008065 – 1010 (10 min)

21 ticks

Reversal to 0.008048 – 1040 (40 min)

17 ticks

Notes: Report fell short of the forecast by 1.4 pts. This caused a 16 tick long spike that started on the 13/20 SMAs and rose to cross the PP Pivot and OOD. With JOBB and a 3 tick bracket, your long entry would have filled at 0.008048 with 1 tick of slippage, then you would have seen it step up to cross the OOD allowing an exit with 10 ticks where it hovered. After that it reversed 6 ticks in 2 min before climbing for a 2nd peak of 5 more ticks in 7 min. Then it reversed 17 ticks in 30 min after crossing the PP Pivot and 50 SMA.