2/11/2016 Weekly Natural Gas Storage Report (1030 EST)

Forecast: -82B

Actual: -70B

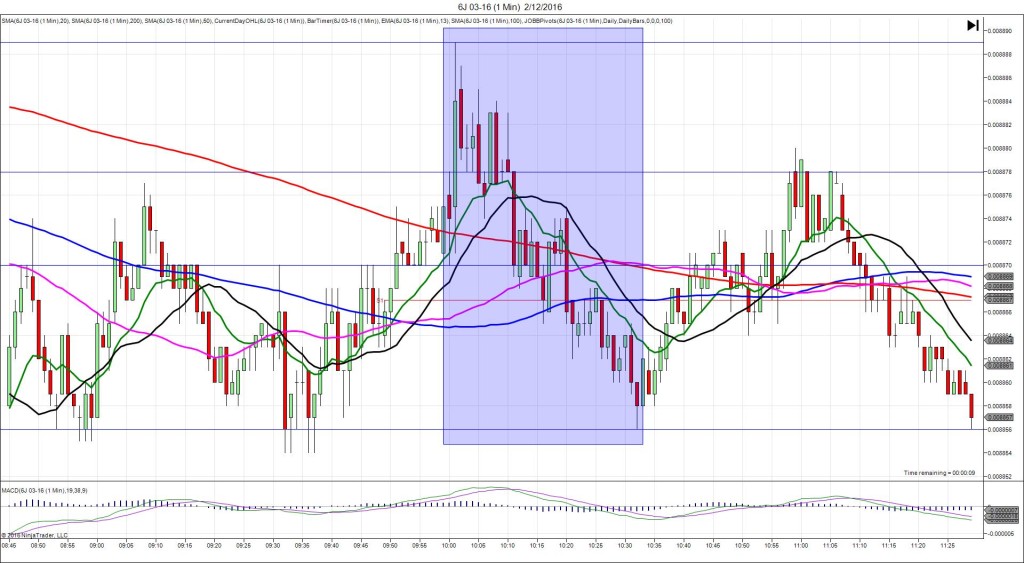

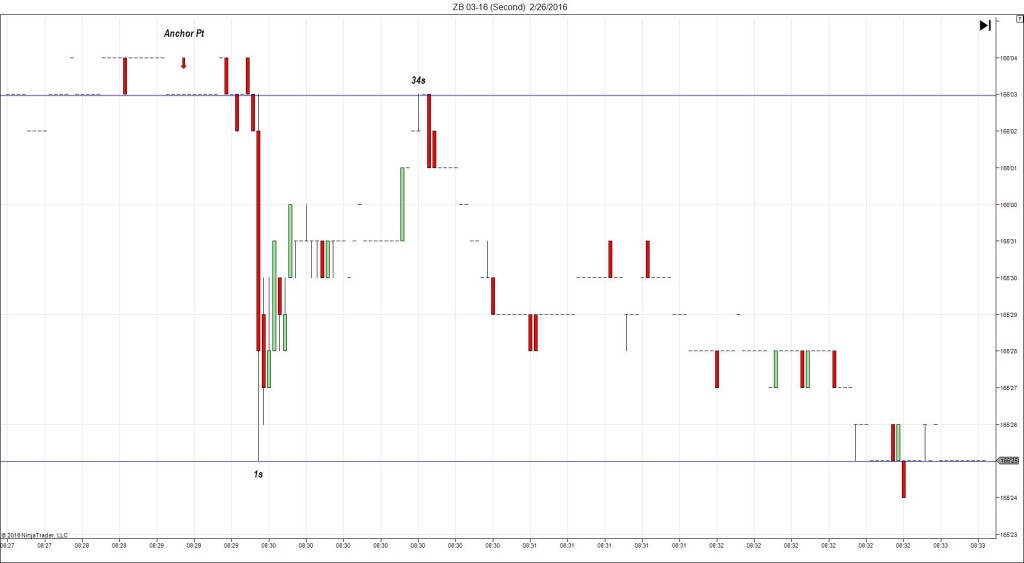

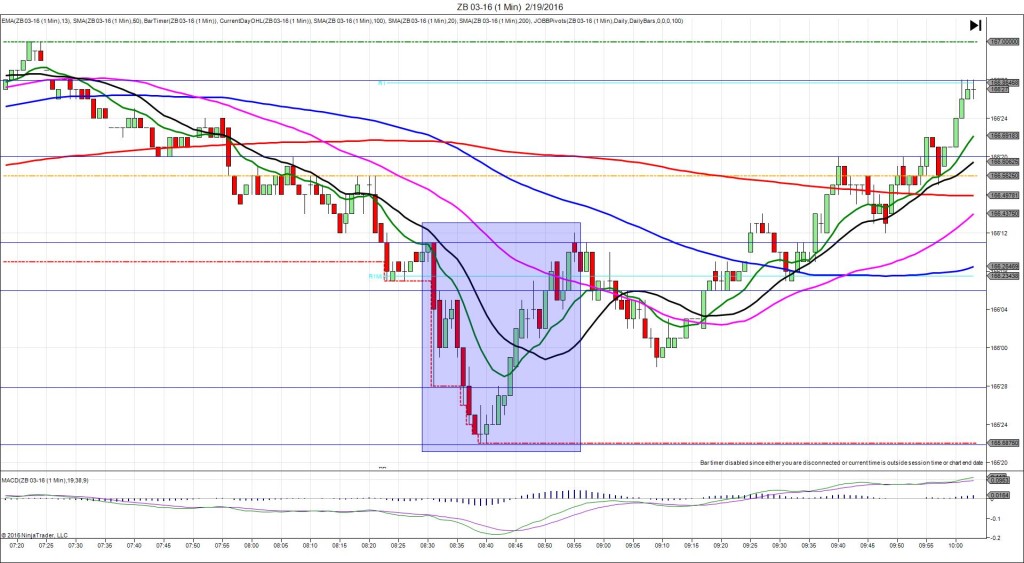

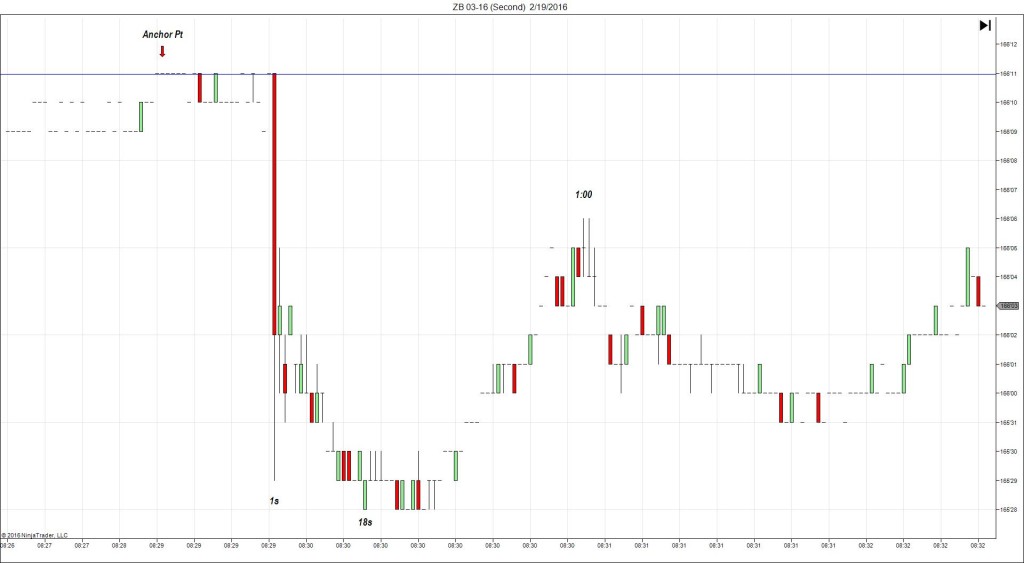

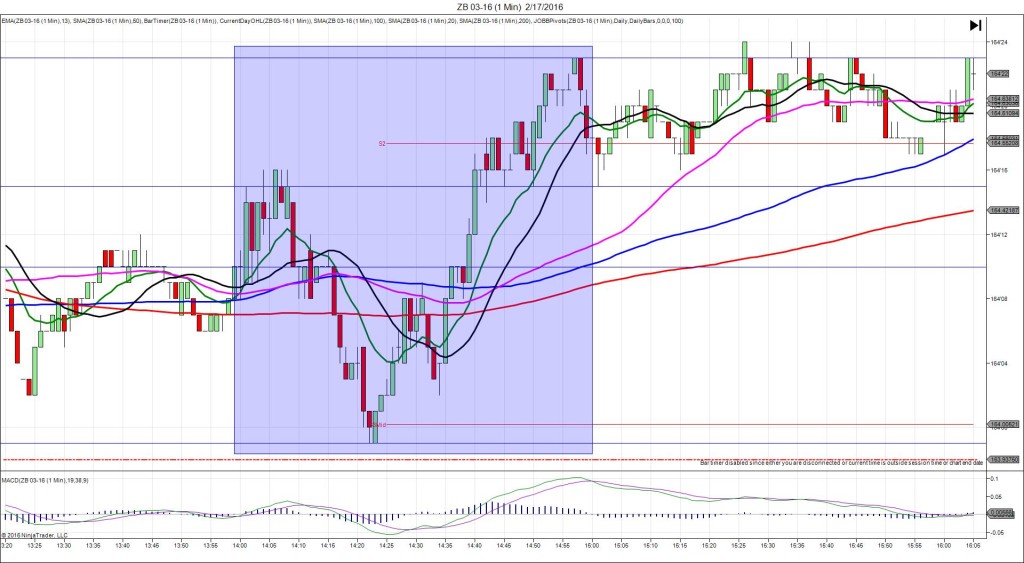

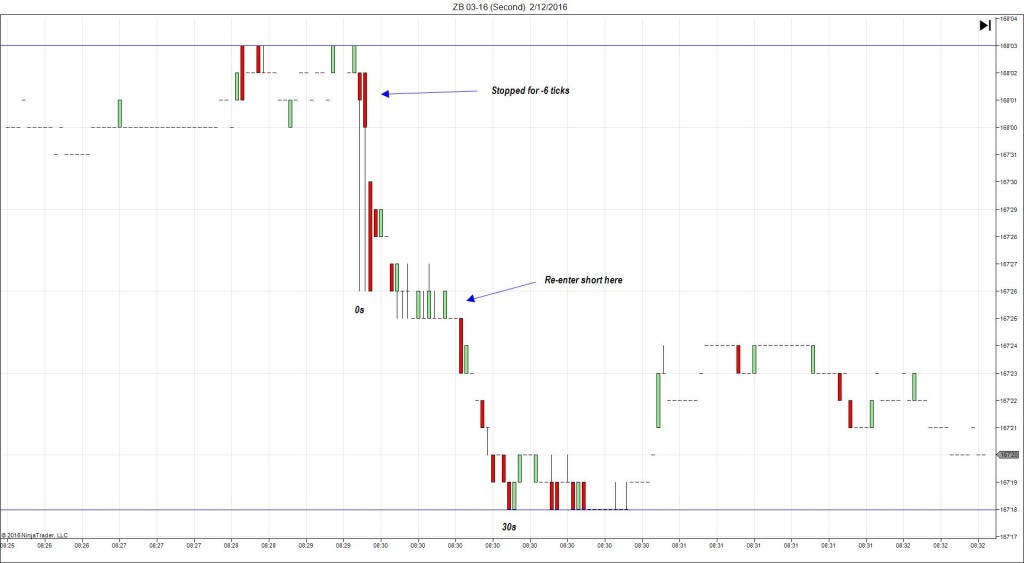

SPIKE WITH 2ND PEAK

Started @ 2.051

1st Peak @ 2.007 – 1031:17 (2 min)

44 ticks

Reversal to 2.029 – 1034 (4 min)

22 ticks

Final Peak @ 1.983 – 1128 (58 min)

68 ticks

Reversal to 2.003 – 1141 (71 min)

20 ticks

Expected Fill: 2.041 (short)

Slippage: 0 ticks

Best Initial Exit: 2.008 – 33 ticks

Recommended Profit Target placement: 2.008 (just below the S1 Pivot)

Notes: Fairly Stable short spike offered a rare no slippage fill then would have targeted the S1 Pivot nicely after about 1.5 min. After a small reversal, it turned into a slow downtrend to gather another 24 ticks and eclipse the S2 Mid Pivot.