2/3/2014 Monthly ISM Manufacturing PMI (1000 EST)

Forecast: 56.2

Actual: 51.3

Previous revision: n/a

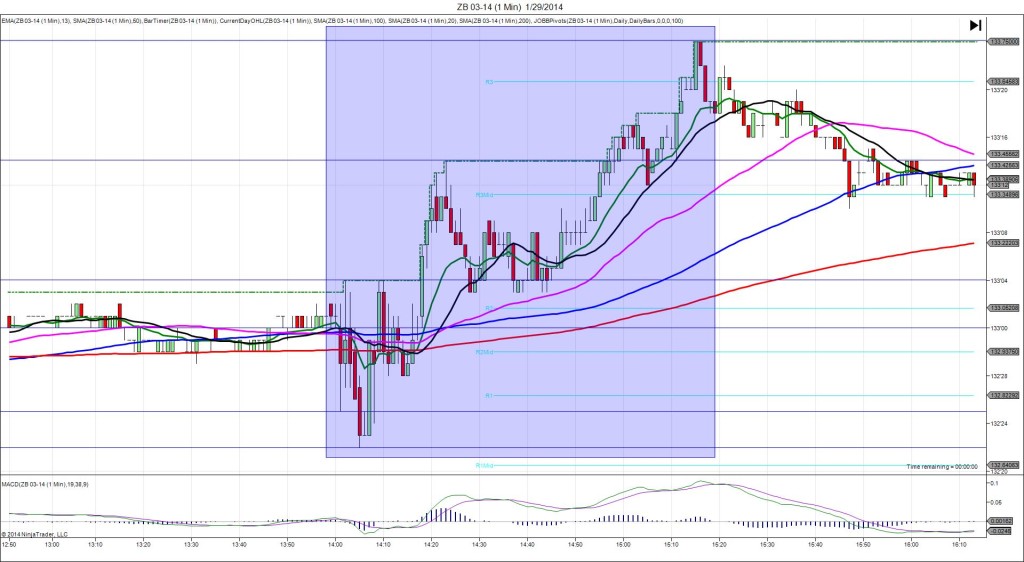

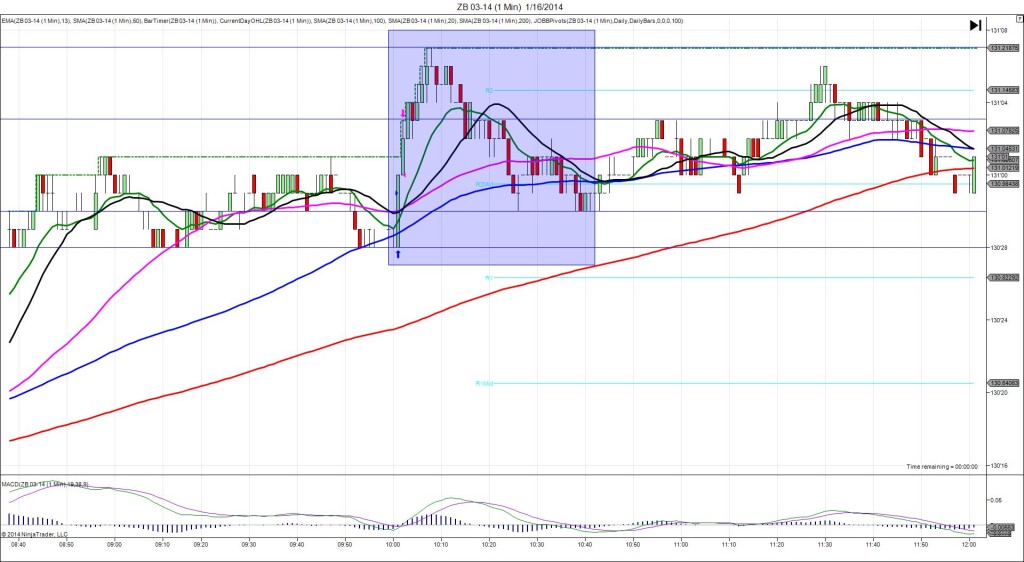

SPIKE WITH 2ND PEAK

Started @ 133’22

1st Peak @ 134’06 – 1001 (1 min)

16 ticks

2nd Peak @ 134’15 – 1014 (14 min)

25 ticks

Reversal to 134’06 – 1048 (48 min)

9 ticks

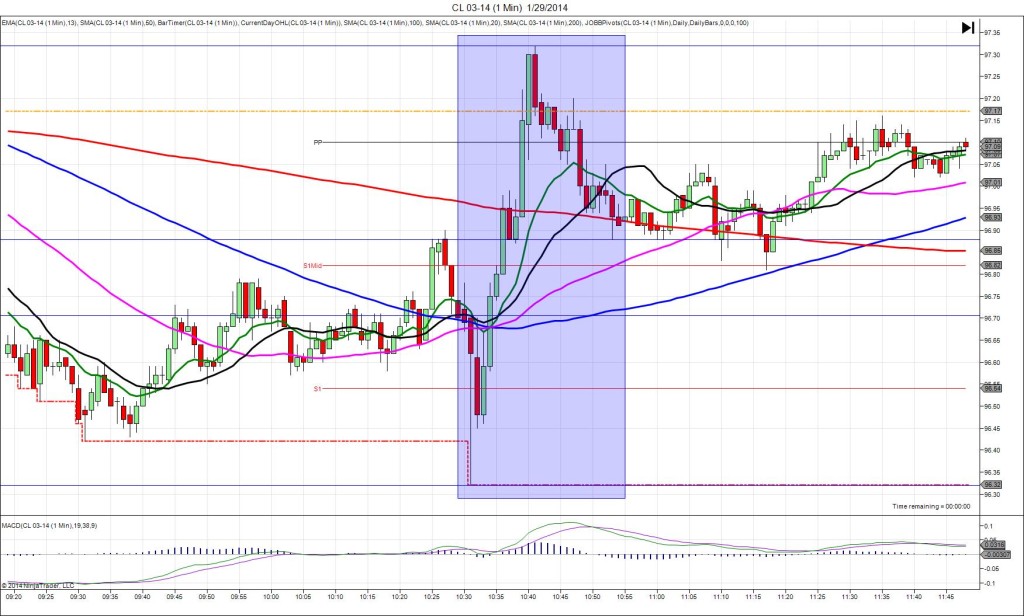

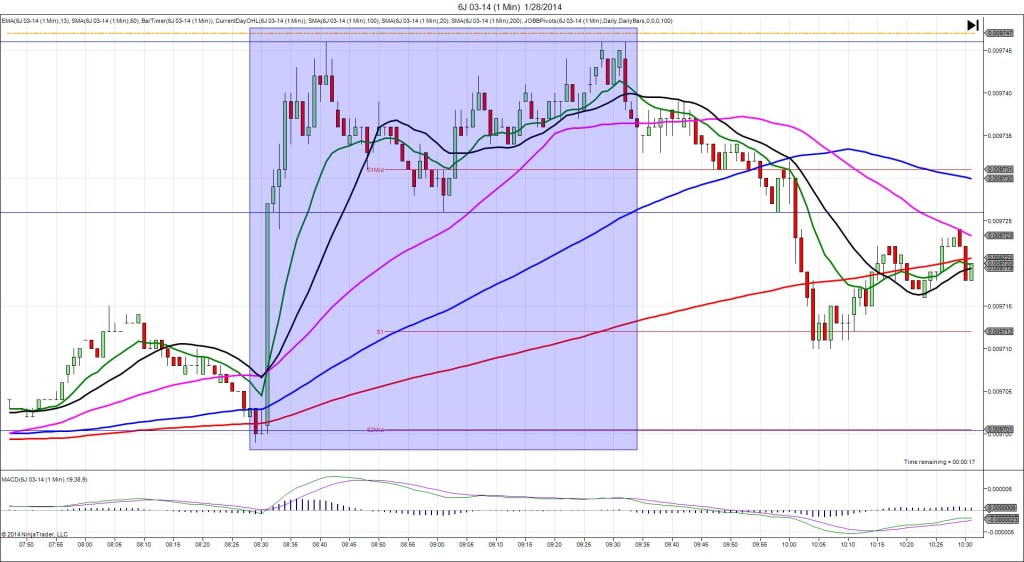

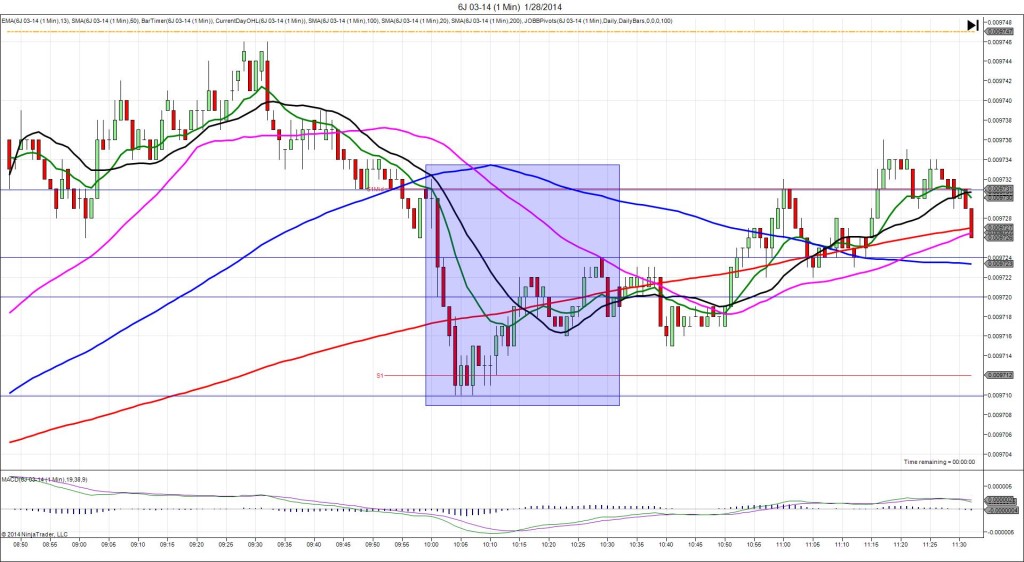

Notes: Report came in very weak, with a result nearly 5 points below the forecast causing a large bullish reaction. We saw a long spike of 16 ticks on the :01 bar that started on the 50 SMA / PP Pivot and crossed the R2 Pivot. With JOBB, you would have filled long at 133’26 with 1 tick of slippage, then seen it hit the R2 Pivot and hover in that area for the rest of the bar. I used a 10 tick target that filled instantly. After a small pullback, it continued to climb for another 9 ticks in the next 13 min, crossing the R3 Mid Pivot. After that it reversed 9 ticks back to the 1st peak area, crossing the 50 SMA and nearly reaching the R2 Pivot in 34 min. Then it rebounded and slowly edged higher in the next few hours.