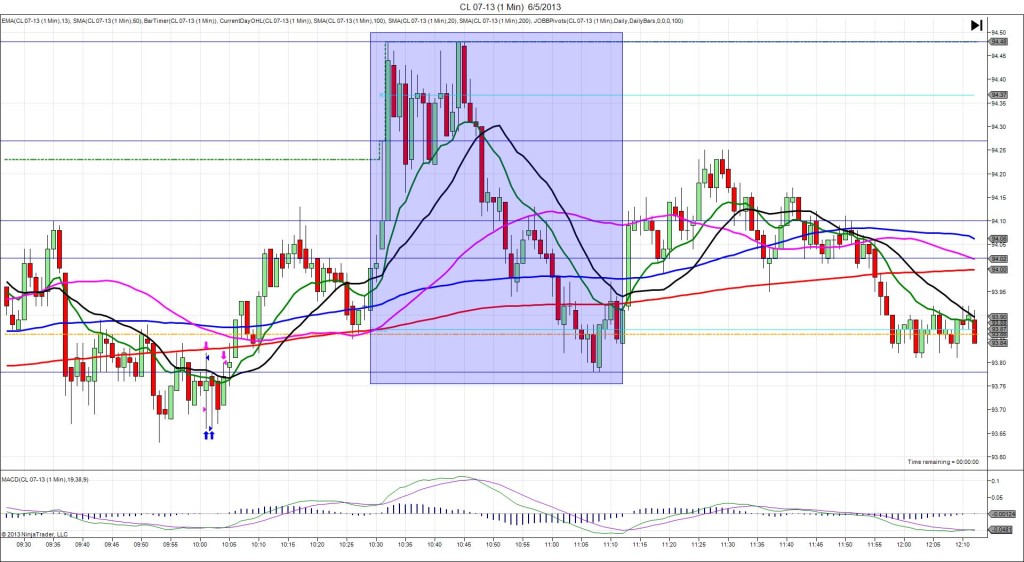

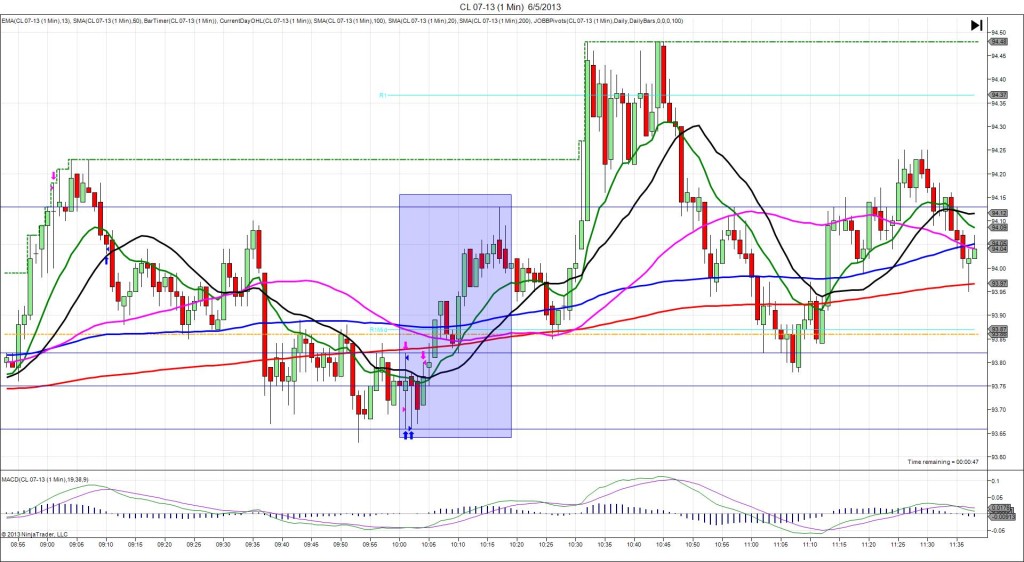

6/12/2013 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: -1.4M

Actual: 2.5M

INDECISIVE

Started @ 95.88

1st Peak @ 95.72 – 1031 (1 min)

16 ticks

Reversal to 96.11 – 1031 (1 min)

-39 ticks

2nd Peak @ 95.50 – 1054 (24 min)

38 ticks

Reversal to 96.45 – 1124 (54 min)

95 ticks

Notes: Moderate gain on the crude inventories when a small draw was expected, while gasoline saw a moderate gain. Commercial oil inventories remain just off of record highs. We saw a short spike of 16 ticks in 1 min that eclipsed the R1 Pivot, followed by a choppy reversal that crossed the 100/50 SMAs and hit the R2 Mid Pivot for 39 ticks. With JOBB and a 10 tick buffer, you would have filled short at 95.76 with 2 ticks of slippage, then seen it chop between 3 and 14 ticks in the red. The safe play in this situation would be to collapse the stop loss to about -7 ticks and look to exit as close to break even as possible. Otherwise, you would have been stopped for -15 ticks about 45 sec into the :31 bar. After the :31 bar, it chopped lower to cross the 200 SMA for a 2nd peak of 22 more ticks in 20 min, then it reversed for 95 ticks in 30 min to extend the HOD 15 ticks.