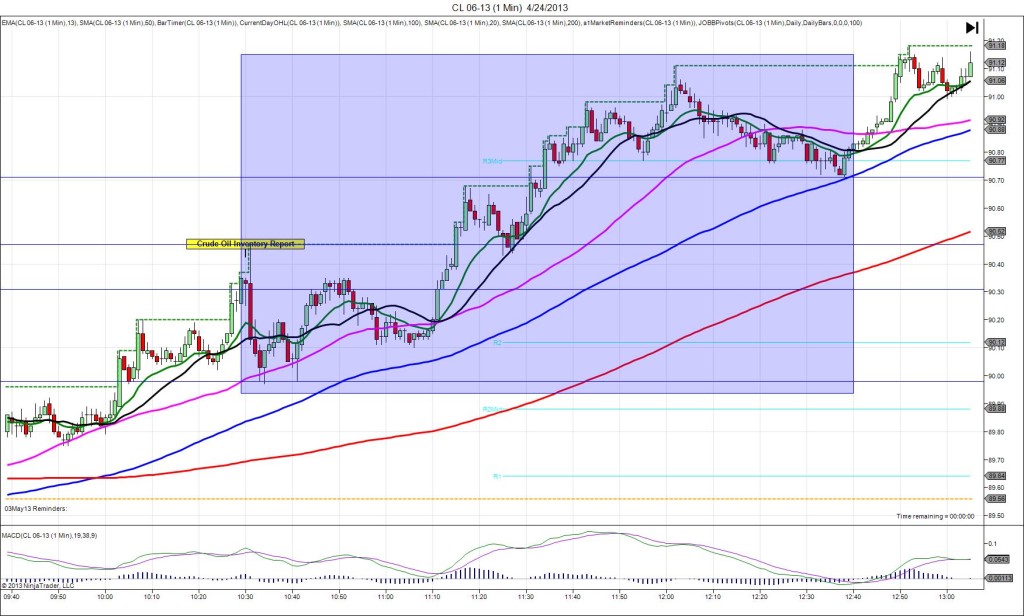

4/24/2013 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: 1.8M

Actual: 0.9M

INDECISIVE

Started @ 90.31

1st Peak @ 90.47 – 1031 (1 min)

16 ticks

Reversal to 90.11 – 1031 (1 min)

-36 ticks

2nd Peak @ 91.11 – 1202 (92 min)

80 ticks

Reversal to 90.71 – 1238 (128 min)

40 ticks

Notes: Minimal gain in crude inventories when a more sizable gain was expected, while gasoline saw a large draw and distillates saw no change. Commercial oil inventories are categorized as above their upper limit though. This prompted an indecisive scenario that rallied for 16 ticks first before reversing for 36 ticks on the :31 bar. The gasoline draw caused the long move, then the large inventories of crude reversed the sentiment. With JOBB and a 10 tick buffer, you would have filled long at about 90.44 with 3 ticks of slippage, then been stopped almost immediately as it left the wick naked at 90.26 with 3 ticks of slippage. After the initial indecision, it chopped sideways and eventually returned to the bullish trend in place before the report as the gasoline results drove it up to over $91 about an hour after the report.