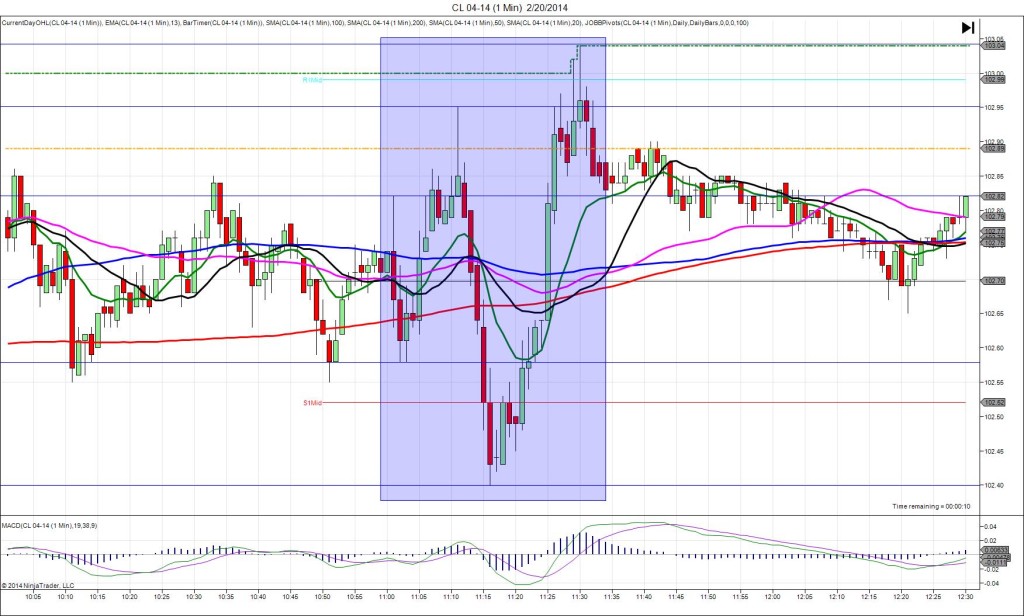

2/20/2014 Weekly Crude Oil Inventory Report (1100 EST)

Forecast: 2.01M

Actual: 0.97M

Gasoline

Forecast: -0.54M

Actual: 0.31M

Distillates

Forecast: -1.89M

Actual: -0.34M

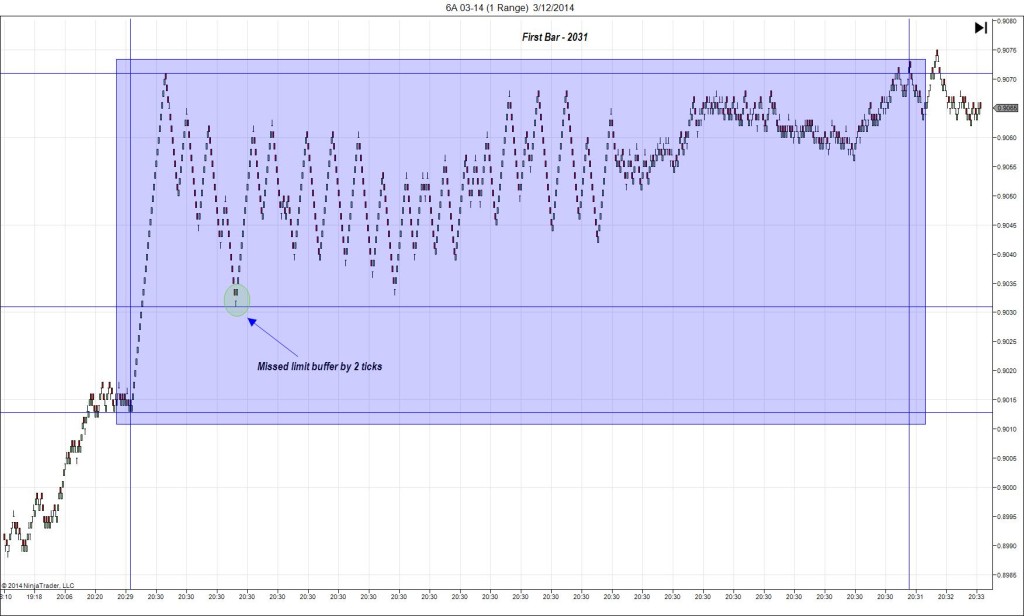

DULL REACTION (NO FILL)

Started @ 102.74

1st Peak @ 102.82 – 1031 (1 min)

8 ticks

Reversal to 102.58 – 1032 (2 min)

24 ticks

Notes: Modest gain in inventories when a greater gain was expected, while gasoline saw a negligible gain when a negligible draw was expected and distillates saw a negligible draw when a modest draw was expected. This news seemed to be mostly balanced to even the scales between the bulls and the bears to cause a dull reaction. With JOBB and a 10 tick buffer, you would not have seen an impulse to fill either side of the bracket until 19 sec into the :31 bar, so you should have cancelled the order. It eventually fell for 16 ticks from the origin as it crossed the 200 SMA. Then it transitioned into large swings: a rally of 37 ticks in 9 min, then a drop of 55 ticks in 5 min, then a rally of 64 ticks in 14 min, before settling down to trade in the range it was before the news.