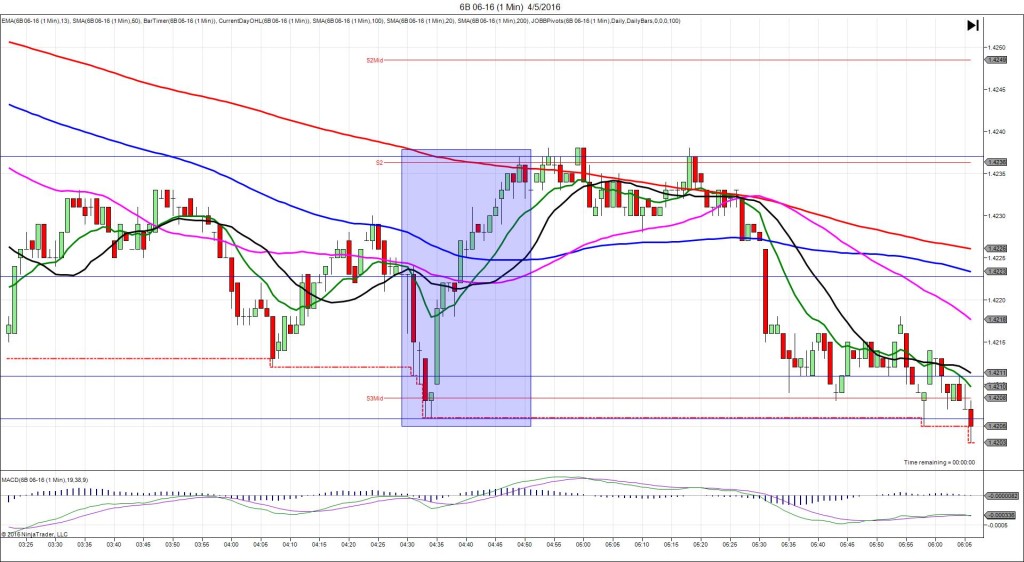

4/8/2016 Employment Change (0830 EDT)

Employment Change Forecast: 10.4K

Employment Change Actual: 40.6K

Previous Revision: n/a

Rate Forecast: 7.3%

Rate Actual: 7.1%

SPIKE / REVERSE (TRIGGER TO CANCEL)

Started @ 0.7653

1st peak @ 0.7694 – 0830:08 (1 min)

41 ticks

Reversal to 0.7673 – 0831:00 (2 min)

21 ticks

Pullback to 0.7695 – 0841 (11 min)

42 ticks

Reversal to 0.7682 – 0848 (18 min)

13 ticks

Expected Fill: n/a – cancel

Slippage: n/a

Best Initial Exit: n/a

Recommended Profit Target placement: n/a

Notes: Premature spike at 0829:46 would have disqualified the trade as it climbed 15 ticks and collapsed. Then it was frenetic in the ascent after the news and surrendered half of the spike immediately. The only opening hear is a buy on a potential 2nd peak at the .7675 area as it found support. Then look to capture 15 – 20 ticks as you evaluate how it handles the R3 Mid Pivot.