11/10/2014 World Agriculture Supply and Demand Estimates (WASDE) – Soybeans (1200 EST)

Forecast: n/a

Actual: n/a

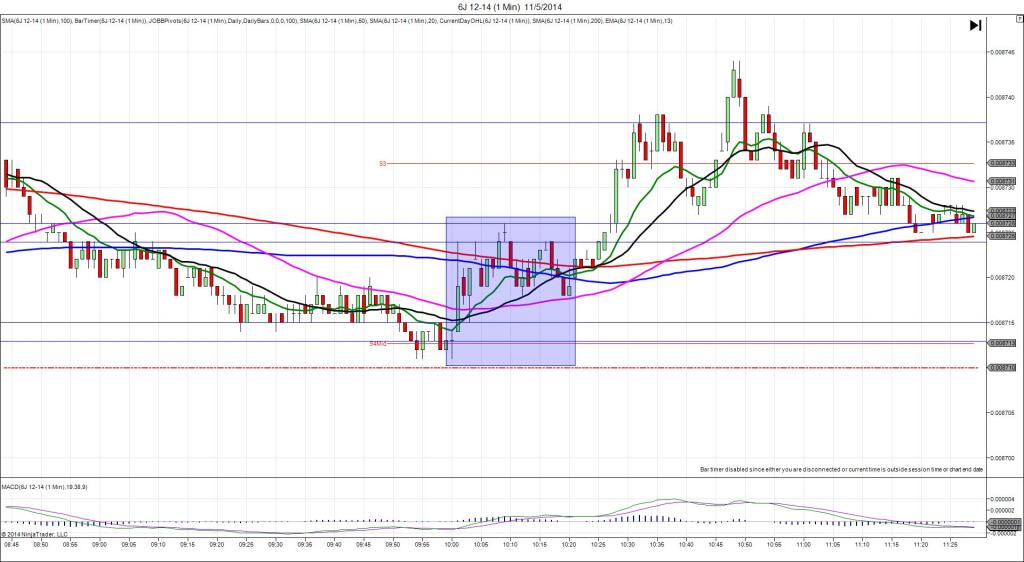

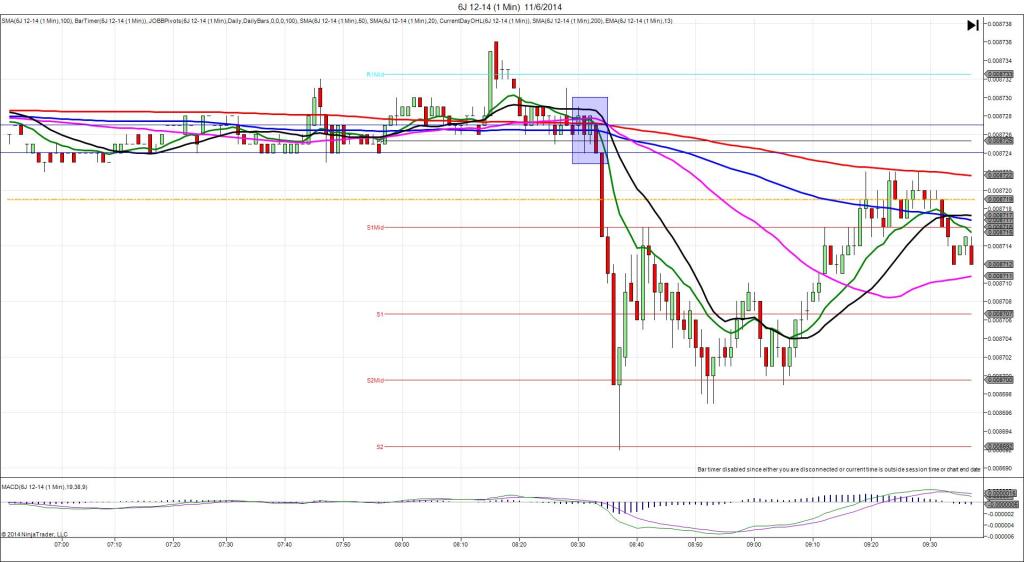

SPIKE WITH 2ND PEAK

Started @ 1043.75 (1200:32)

1st Peak @ 1036.00 – 1200:35 (1 min)

31 ticks

Reversal to 1044.75 – 1203 (3 min)

35 ticks

2nd Peak @ 1025.50 – 1212 (12 min)

73 ticks

Reversal to 1038.00 – 1232 (32 min)

50 ticks

Final Peak @1021.75 – 1334 (94 min)

88 ticks

Notes: With the beans, we recommend a delayed setup at 32 sec. In this case the initial reaction would have been unsafe to trade as it shot long 16 ticks, then reversed strongly. As usual, it would have been tame as it hovered below the 200 SMA and R1 Pivot to provide an anchor point at 1043.75 at 32 sec. With JOBB, your short entry would have filled at 1041.75 with 2 ticks of slippage, then you would have seen it fall immediately for 31 ticks to nearly reach the OOD. Then it backed off a few ticks and chopped sideways. A target set at 1037.00 would have filled easily for about 19 ticks. It eventually reversed for 35 ticks in about 90 sec to the area of the 200 SMA and R1 Mid Pivot. Then it fell for a 2nd peak of another 42 ticks after 9 min to reach the S1 Pivot and extend the LOD. Then it reversed 50 ticks in 20 min before falling slowly for a final peak of 15 more ticks after about an hour.