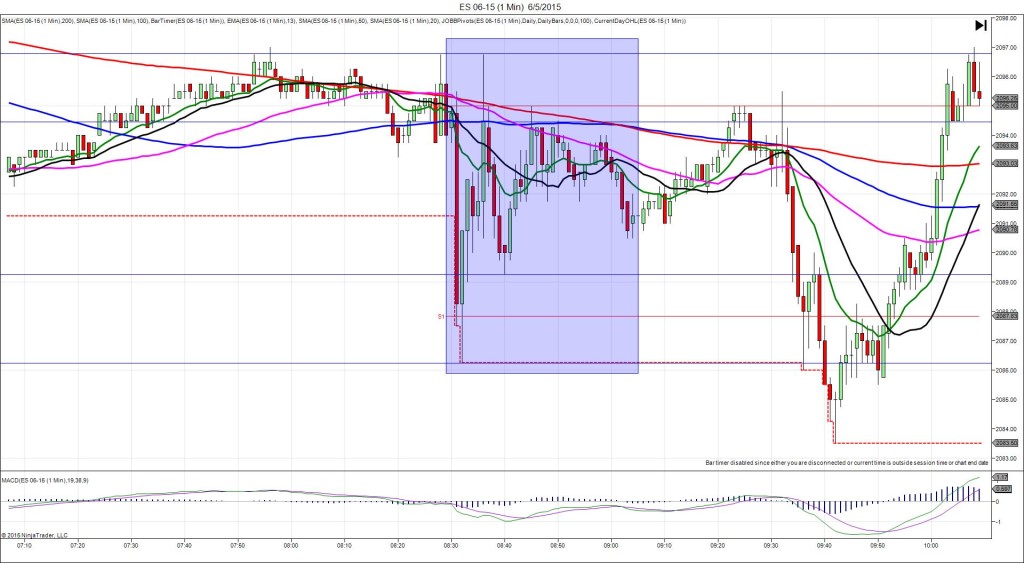

6/5/2015 Monthly Unemployment Report (0830 EDT)

Non Farm Jobs Forecast: 222K

Non Farm Jobs Actual: 280K

Previous Revision: -2K to 221K

Rate Forecast: 5.4%

Rate Actual: 5.5%

TRAP TRADE – DULL NO FILL

Anchor Point @ 2094.50 (on the 100 SMA)

————

Trap Trade:

)))1st Peak @ 2088.75 – 0830:17 (1 min)

)))-23 ticks

)))Reversal to 2095.50 – 0830:21 (1 min)

)))27 ticks

)))Pullback to 2086.25 – 0831:20 (2 min)

)))-37 ticks

————

Reversal to 2096.75 – 0836 (6 min)

42 ticks

Pullback to 2089.25 – 0840 (10 min)

30 ticks

Reversal to 2095.00 – 0845 (15 min)

23 ticks

Trap Trade Bracket setup:

Long entries – 2087.75 (just below the S1 Pivot) / 2084.50 (No SMA / Pivot near)

Short entries – 2101.75 (just below the PP Pivot) / 2104.50 (No SMA / Pivot near)

Notes: Strong report with 58K more jobs added than the forecast, a negligible revision to the previous report along with a increase in the U-3 rate that was attributed to more people looking for work. This caused a short spike of 23 ticks in 17 sec that would have barely missed the inner long tier by 4-5 ticks. As it hovered in a range of 5 ticks for 5 sec, if you were quick you could have moved the tier up about 6 ticks and seen the reversal of 27 ticks give you a nice profit of up to 20 or so ticks with an exit above the 100 SMA. Then it continued to swing up and down about every 4-5 min to allow plenty of opportunities to “sell the rips and buy the dips”.