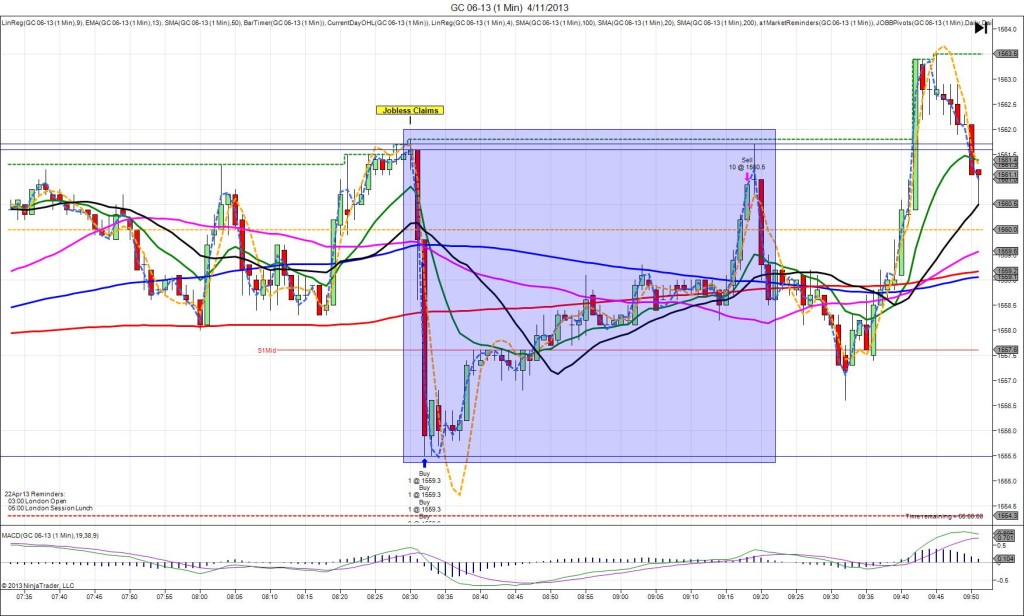

4/25/2013 Weekly Unemployment Claims (0830 EDT)

Forecast: 352K

Actual: 339K

SPIKE WITH 2ND PEAK

Started @ 1453.4

1st Peak @ 1451.4 – 0831 (1 min)

20 ticks

Reversal to 1453.6 – 0835 (5 min)

22 ticks

2nd Peak @ 1444.7 – 0939 (69 min)

87 ticks

Reversal to 1457.4 – 1023 (113 min)

127 ticks

Notes: Report came in better than the forecast by 13k jobs, but caused a relatively muted reaction of only 20 ticks after a huge rally of about 100 ticks in the 30 min before the report. After establishing a much higher HOD, it backed off, then the bearish report was released and it could not go lower than the R3 Pivot and 13 SMA for about 30 min. Then it finally fell for a 2nd peak of 87 ticks culminating over an hour after the report to eclipse the R3 Mid Pivot. After that the reversal popped back up 127 ticks in about 45 min. With JOBB, you would have filled short on the :31 bar at about 1452.3 with 1 tick of slippage, then had an opportunity for a handful of ticks. I waited several min, expecting a drop through the R3 Pivot. After 10 min, I closed out fearing the influence of the report would be waning and it could resume the rally from earlier.