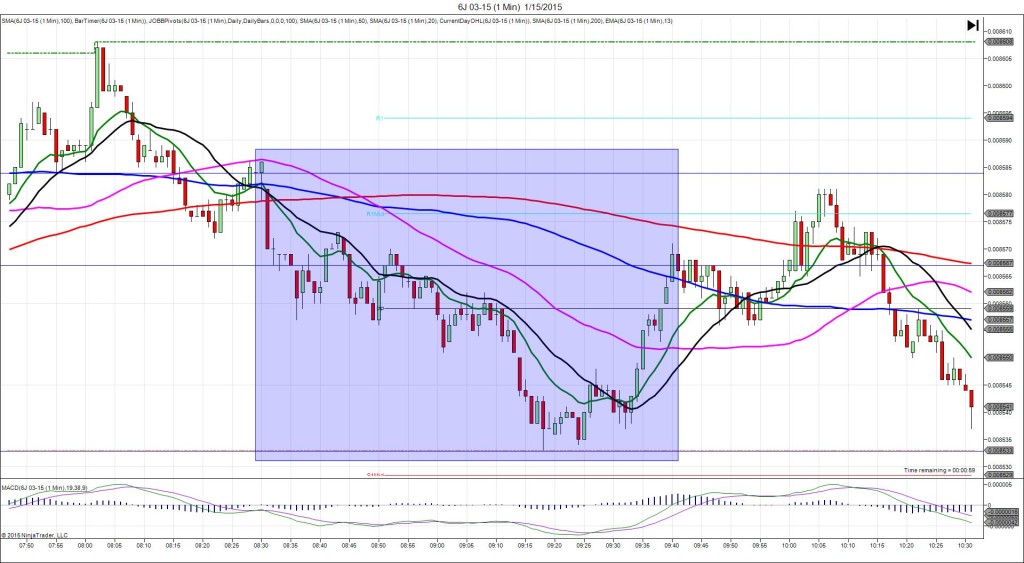

1/7/2015 FOMC Meeting Minutes (1400 EST)

Previous: n/a

Actual: n/a

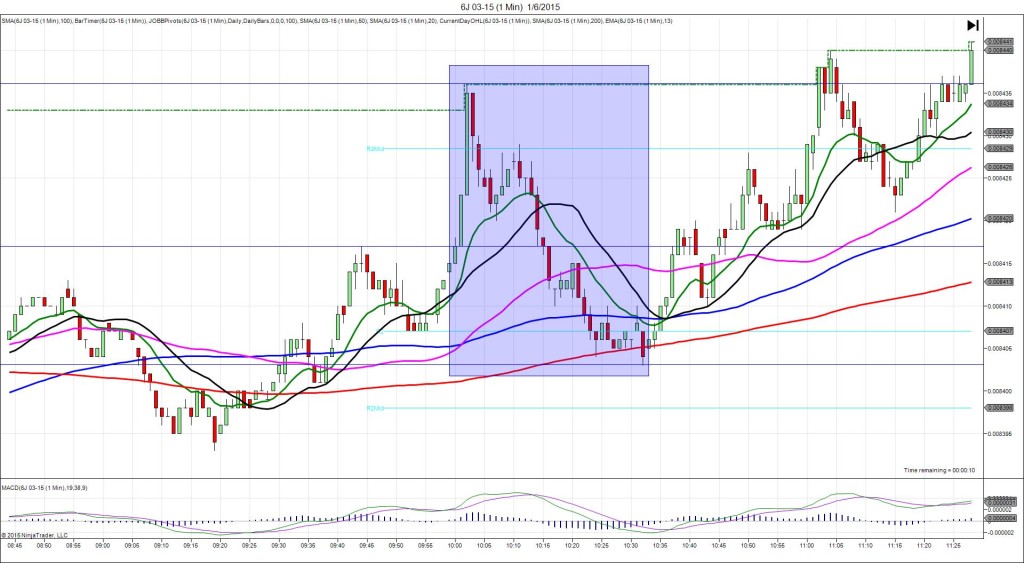

TRAP TRADE – INNER TIER (SPIKE WITH 2ND PEAK)

Anchor Point @ 147’27 (shift to 147’28)

————

Trap Trade:

)))1st Peak @ 148’02 – 1400:07 (1 min)

)))6 ticks

)))Reversal to 147’24 – 1400:19 (1 min)

)))-10 ticks

————

Final Peak @ 148’17 – 1444 (44 min)

22 ticks

Reversal to 148’01 – 1509 (69 min)

16 ticks

Continued Reversal to 147’26 – 1638 (158 min)

23 ticks

Trap Trade Bracket setup:

Long entries – 147’22 (just below the S1 Mid Pivot) / 147’19 (no SMA / Pivot near)

Short entries – 148’01 (no SMA / Pivot near) / 148’04 (below the PP Pivot)

Notes: The minutes revealed that the FED was still accommodative to dovish policy while taking a tolerant approach to risk assets. This caused a quick long spike of 6 ticks in 7 sec as it broke outside of the tightly clustered SMAs, then a retreat in the next 12 sec of 10 ticks that matched the low around 1336 just above the S1 Mid Pivot. This would have filled the inner short tier at 148’01 then fallen and hovered in between 147’24 and 147’26 to allow 7-9 ticks to be captured easily. After that it ascended for a final peak of 16 more ticks after 43 more min to the OOD. Then it reversed 16 ticks to the 100 SMA in 25 min followed by another 7 ticks in 89 min just before the session close.