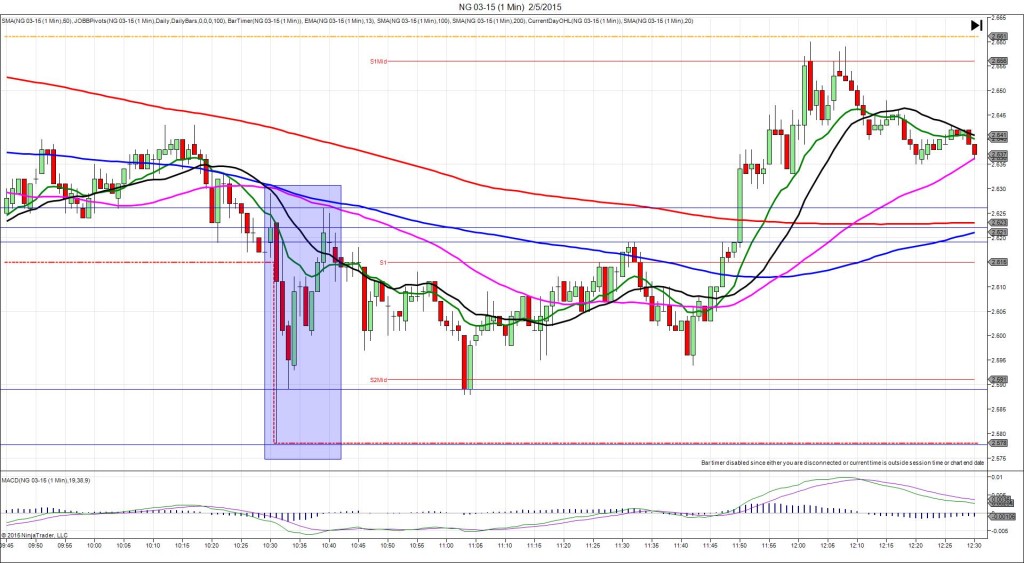

2/5/2015 Weekly Natural Gas Storage Report (1030 EST)

Forecast: -119B

Actual: -115B

SPIKE / REVERSE

Started @ 2.622

1st Peak @ 2.578 – 1030:10 (1 min)

44 ticks

Reversal to 2.619 – 1032 (2 min)

41 ticks

Pullback to 2.589 – 1033 (3 min)

30 ticks

Reversal to 2.626 – 1039 (9 min)

37 ticks

Notes: We saw a smaller draw on the reserve compared to the forecast which caused a moderate short move that fell quickly to cross the S2 Mid Pivot then retreat late in the bar. With JOBB and a 10 tick bracket, your short order would have filled around 2.597 with 15 ticks of slippage. Then you would have seen it chop around the fill point before settling to hover around 2.583 for 7 sec. Look to exit there with about 14 ticks. Then it reversed 41 ticks to the 13 SMA on the next bar before pulling back 30 ticks it the S2 Mid Pivot on the following bar. Then it reversed 37 ticks in 6 min to the 50/100 SMAs. After that it drifted lower and chopped sideways.