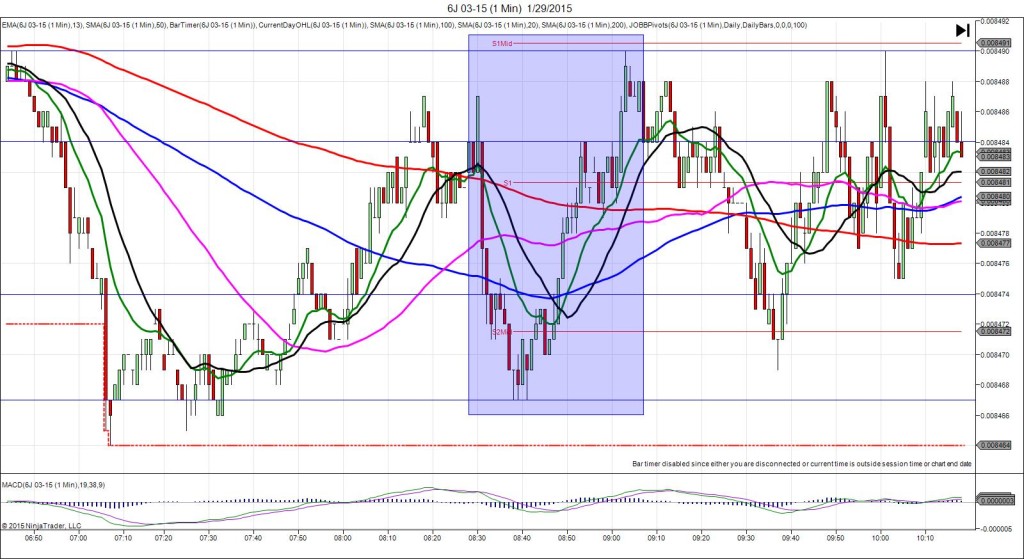

1/29/2015 Weekly Unemployment Claims (0830 EST)

Forecast: 301K

Actual: 265K

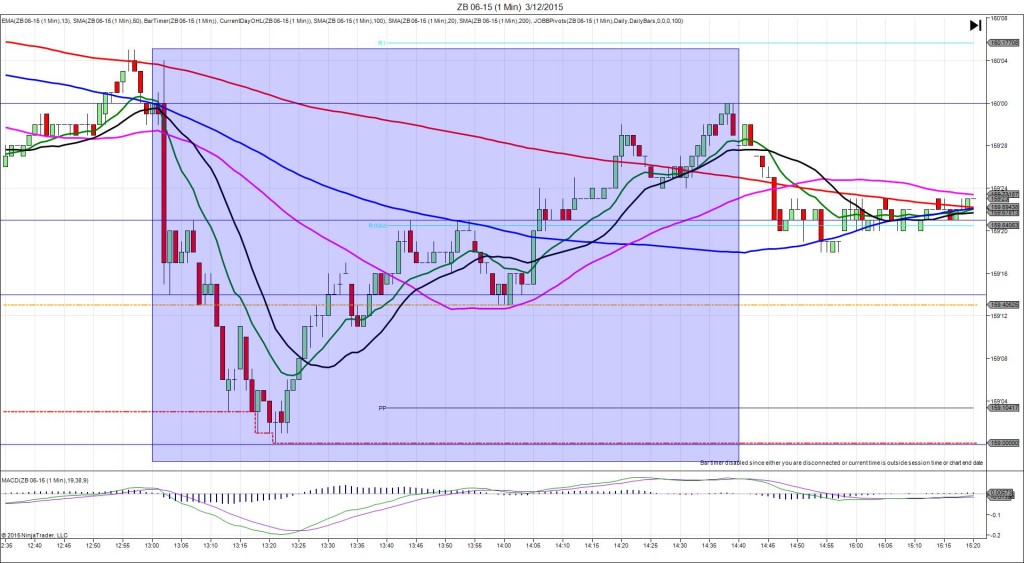

TRAP TRADE – DULL NO FILL (SPIKE WITH 2ND PEAK)

Anchor Point @ 0.008484 (shift to 0.008497)

————

Trap Trade:

)))1st Peak @ 0.008474 – 0830:38 (1 min)

)))-10 ticks

)))Reversal to 0.008478 – 0830:50 (1 min)

)))4 ticks

————

2nd Peak @ 0.008467 – 0838 (8 min)

17 ticks

Reversal to 0.008490 – 0903 (33 min)

23 ticks

Trap Trade Bracket setup:

Long entries – 0.008475 (just below the 100 SMA) / 0.008465 (just above the LOD)

Short entries – 0.008492 (just above the S1 Mid Pivot) / 0.008502 (just above the PP Pivot)

Notes: Report came in much better than expected with 36k offset. This caused an initial short spike of only 6 ticks then trickled lower. As it was slowly approaching the inner long entry around the 20 sec threshold, cancel the order. With the large offset and slow approach, a strong reversal is unlikely while a 2nd peak is probable. Sure enough, it achieved 10 ticks to the 100 SMA, then reversed only 4 ticks briefly before falling for a 2nd peak of 7 more ticks in 7 min as it crossed the S2 Mid Pivot. Then it reversed 23 ticks, crossing all 3 major SMAs and nearly reached the S1 Mid Pivot.