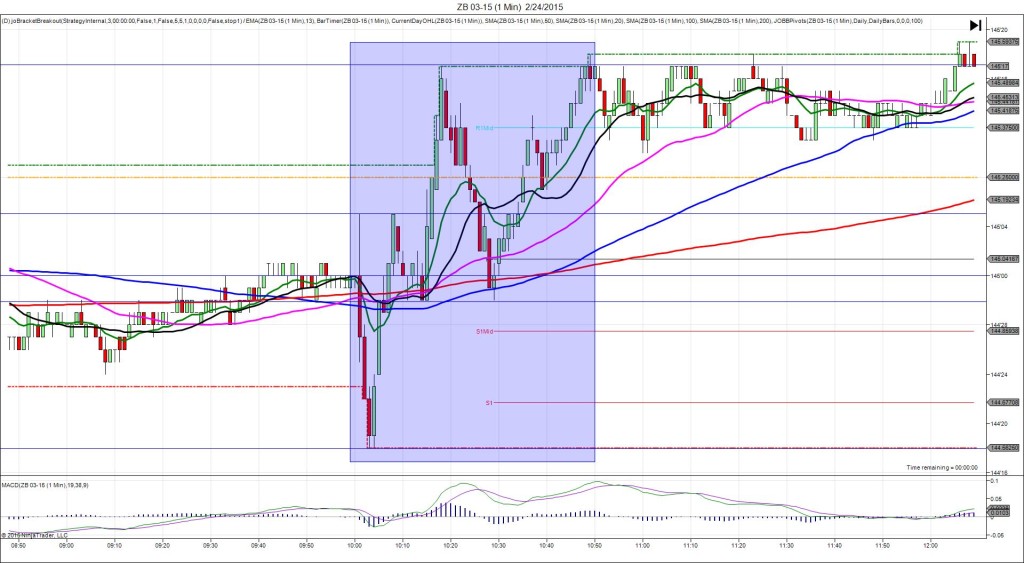

2/19/2015 Weekly Crude Oil Inventory Report (1100 EST)

Forecast: 3.23M

Actual: 7.72M

Gasoline

Forecast: 0.17M

Actual: 0.49M

Distillates

Forecast: -2.05M

Actual: -3.81M

SPIKE WITH 2ND PEAK

Started @ 50.41

1st Peak @ 51.60 – 1101:49 (1 min)

119 ticks

Reversal to 50.61 – 1108 (8 min)

99 ticks

2nd Peak @ 52.39 – 1147 (47 min)

198 ticks

Reversal to 51.70 – 1155 (55 min)

69 ticks

Continued Reversal to 51.32 – 1237 (97 min)

107 ticks

Notes: Another large gain in inventories when a healthy gain was expected, while gasoline saw a negligible gain when a lower negligible gain was expected, and distillates saw a moderate draw when a modest draw was expected. This caused a large long spike that started on the 100 SMA and climbed for a total of 119 ticks in nearly 2 min as it crossed the major SMAs near the origin, the OOD, and extended the HOD. With JOBB and a 10 tick buffer, you would have filled long at about 50.55 with 4 ticks of slippage, then you would have seen it slowly step higher with minimal drawback to allow over 100 ticks to be captured with patience. After that it reversed strongly as it fell 99 ticks in 7 min to the 50 SMA. Then it rallied for a 2nd peak of 79 more ticks in 39 min as it eclipsed the S1 Pivot. Then it reversed 69 ticks in 8 min to nearly reach the S2 Pivot and another 38 ticks in 42 min as it crossed the 100 SMA and nearly reached the OOD.