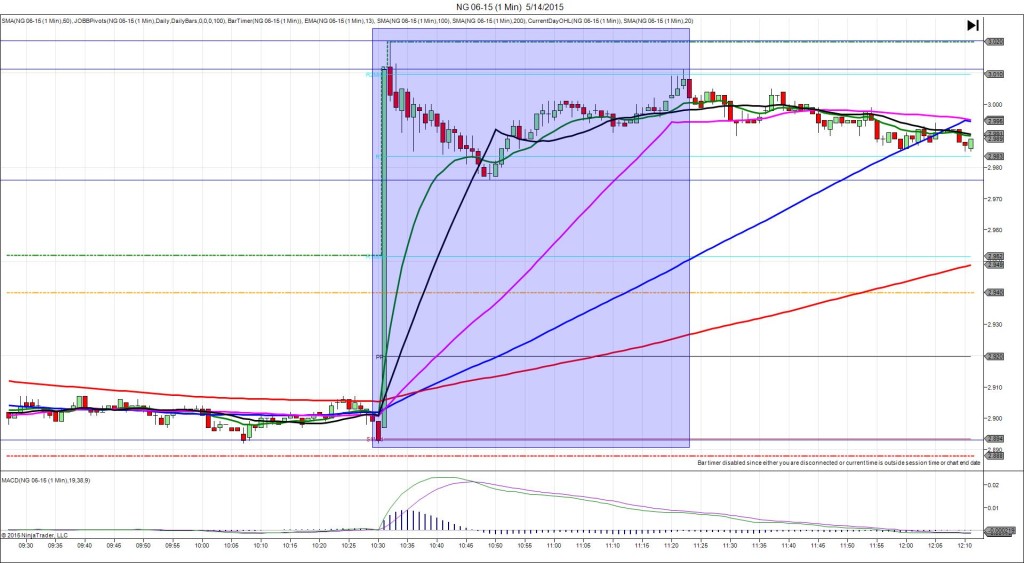

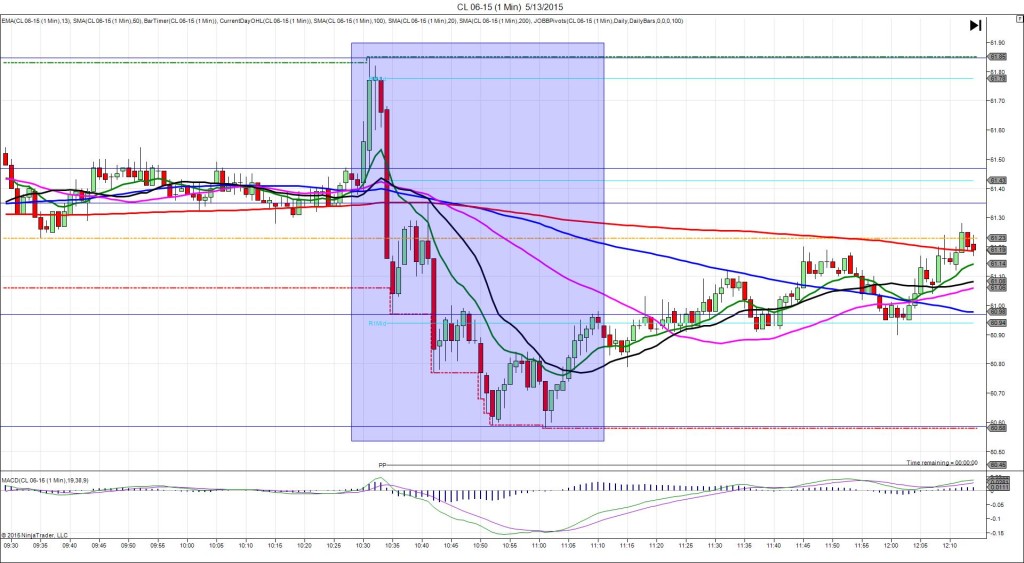

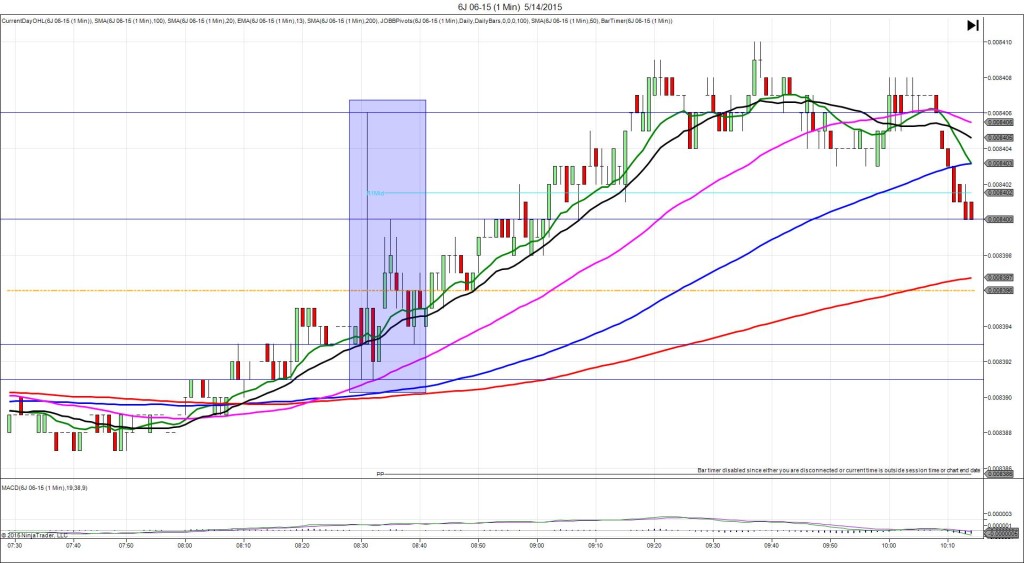

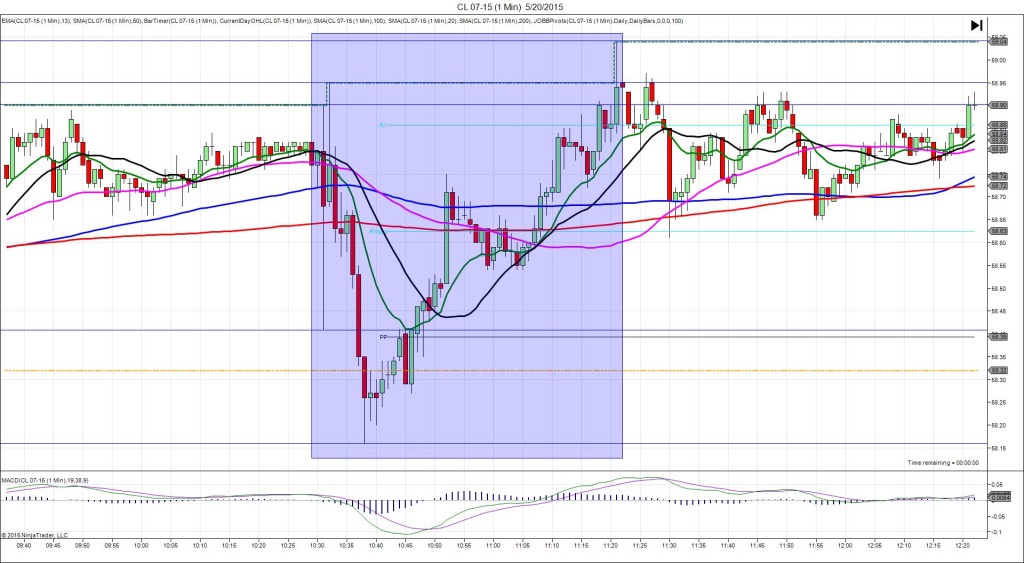

5/14/2015 30-yr Bond Auction (1301 EDT)

Previous: 2.60/2.2

Actual: 3.04/2.2

SPIKE WITH 2ND PEAK

Started @ 153’15 (1301:30)

1st Peak @ 152’26 – 1301:49 (1 min)

21 ticks

Reversal to 153’06 – 1304 (3 min)

12 ticks

Final Peak @ 152’16 – 1318 (17 min)

31 ticks

Reversal to 153’10 – 1330 (29 min)

26 ticks

Double Bottom @ 152’16 – 1412 (71 min)

26 ticks

Notes: Report is scheduled on Forex Factory at the bottom of the hour, but the spike always breaks 1:30 late. The highest yield rose strongly from last month as the bid to cover ratio remained the same. This caused the bonds to fall for another monumental spike of 21 ticks at 1:40 to cross all 3 major SMAs then bottom near a point of support from previous lows in the past few hours. With JOBB you would have filled short at 153’09 with about 3 ticks of slippage, then seen it continue to fall and hover between around 152’30 to allow about 11 ticks to be captured. After the spike, it reversed 12 ticks in 2 min to the 13 SMA before stepping lower for a final peak of 10 more ticks in 14 min to nearly reach the S1 Mid Pivot. Then it reversed 26 ticks to the PP Pivot in 12 min before falling for a double bottom in 42 min.