4/29/2015 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: 2.30M

Actual: 1.91M

Gasoline

Forecast: 0.22M

Actual: 1.71M

Distillates

Forecast: 1.17M

Actual: -0.70M

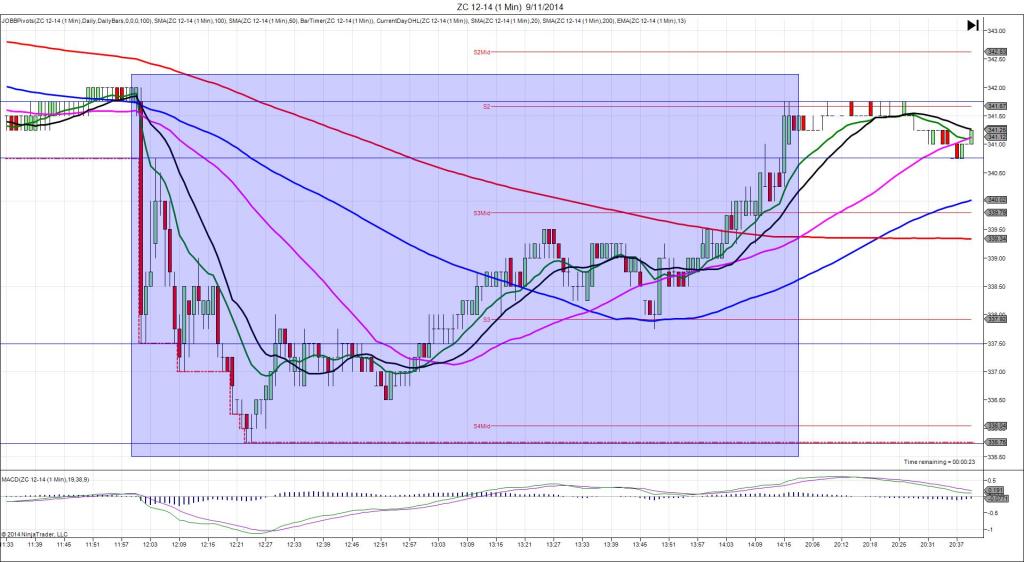

INDECISIVE…UPWARD FAN

Started @ In between 57.31 and 57.20

Premature Spike to 57.19 – 1029:59 (0 min)

1st Peak @ 57.82 – 1030:22 (1 min)

63 ticks

Reversal to 57.60 – 1030:55 (1 min)

22 ticks

2nd Peak @ 58.19 – 1036 (6 min)

100 ticks

Reversal to 57.84 – 1046 (16 min)

35 ticks

Final Peak @ 59.33 – 1250 (140 min)

214 ticks

Reversal to 58.92 – 1308 (158 min)

41 ticks

Notes: Modest gain in inventories when a slightly higher modest gain was expected, while gasoline saw a modest gain when a negligible gain was expected, and distillates saw a negligible draw when a modest gain was expected. This caused a premature short move at 1029:57 for about 17 ticks as the bracket would have established. If the bracket anchor point was 57.29 or higher, you would have been filled short, then stopped as it reversed upon the news release. If your anchor was lower, you would have filled long with higher slippage, but would have been able to profit off of the report . Since the results are variable, we will categorize this as an indecisive report. After the 63 tick spike 1st peak, it reversed 22 ticks in 33 sec before climbing for a 2nd peak of 37 more ticks in 5 min. Then it reversed 35 ticks in 10 min to the 20 SMA before climbing another 114 ticks in about 2 hrs to the R3 Pivot for the final peak. After that it reversed 41 ticks to the 50 SMA.