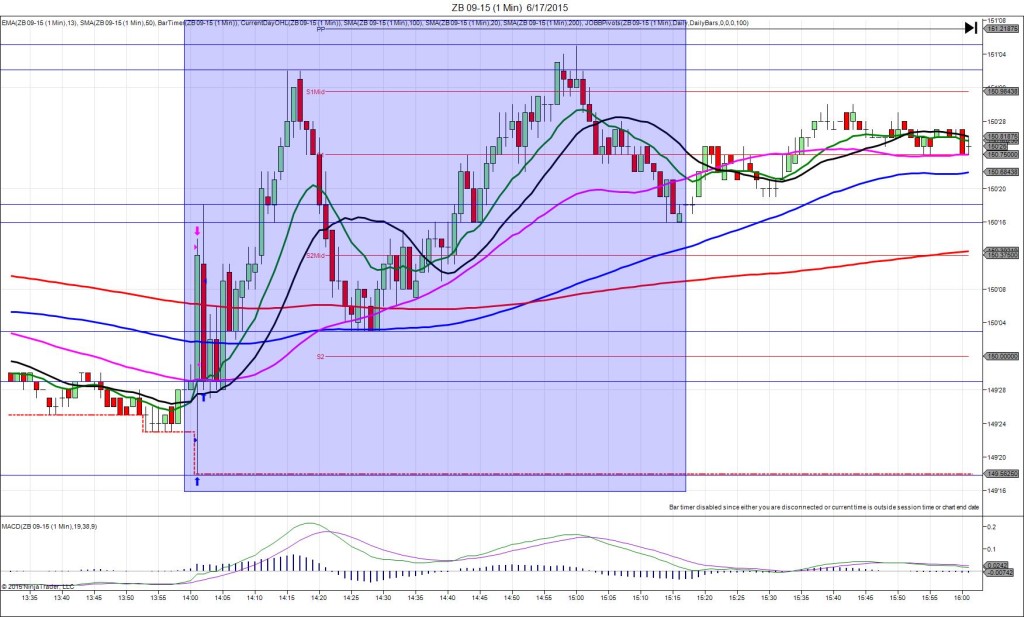

8/12/2014 World Agriculture Supply and Demand Estimates (WASDE) – Corn (1200 EDT)

Forecast: n/a

Actual: n/a

SPIKE / REVERSE

Started @ 358.00

1st Peak @ 366.00 – 1200:06 (1 min)

32 ticks

Reversal to 354.25 – 1200:57 (1 min)

47 ticks

Pullback to 364.50 – 1220 (20 min)

41 ticks

Reversal to 359.00 – 1240 (40 min)

22 ticks

Pullback to 365.50 – 1320 (80 min)

26 ticks

Notes: Report Reaction caused a long move of 32 ticks initially that crossed the 200 SMA, OOD, R1 Pivot and extended the HOD. It was briefly sustained then reversed after 10 sec for 47 ticks to the S3 Mid Pivot as the :01 bar was expiring. With JOBB, you would have filled long at about 360.75 with about 6 ticks of slippage, then seen it climb and hover just above the R1 Pivot for 7 sec. Since this report often reverses at the first sign of hovering, we recommend exiting there which would have secured about 20 ticks. After that it reversed for 47 ticks in the next 51 sec to the S3 Mid Pivot. Then it pulled back for 41 ticks in the next 19 min to the R1 Mid Pivot, offering a great long entry just above the S3 Mid Pivot. Then it fell for 22 ticks to the 200 SMA in 20 min before climbing 26 ticks to the R1 Pivot in the next 40 min. After that it traded sideways and trended higher in the long term.