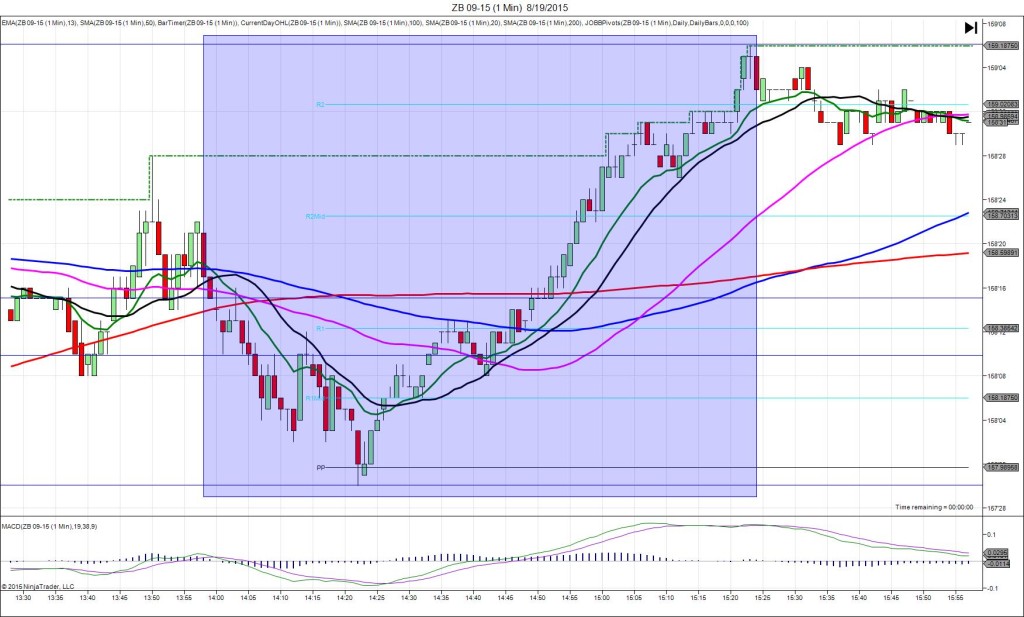

8/18/2015 Monthly Building Permits / Housing Starts (0830 EDT)

Building Permits

Forecast: 1.23M

Actual: 1.12M

Previous revision: n/a

Housing Starts

Forecast: 1.19M

Actual: 1.21M

Previous revision: +0.03 to 1.20M

DULL FILL

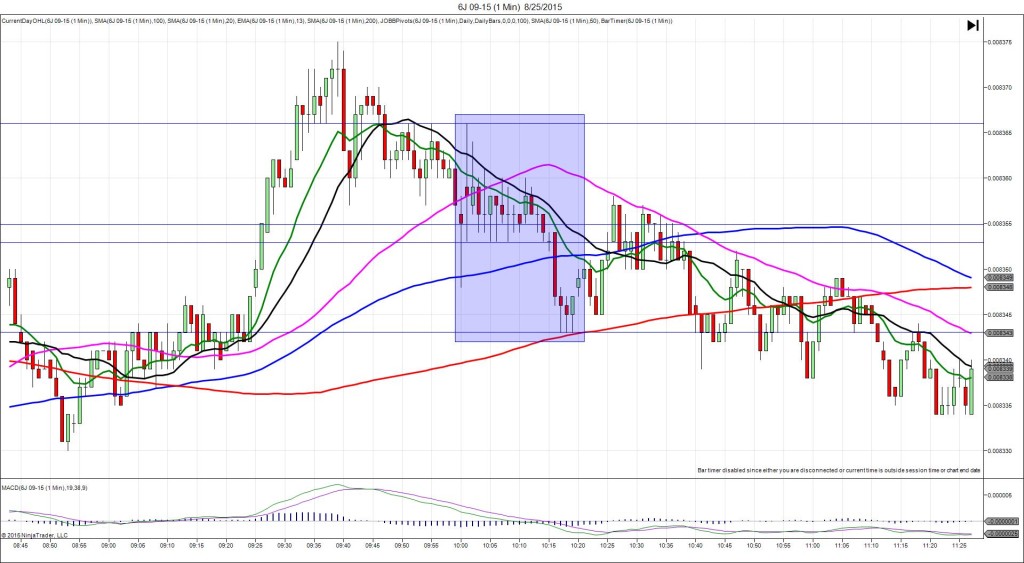

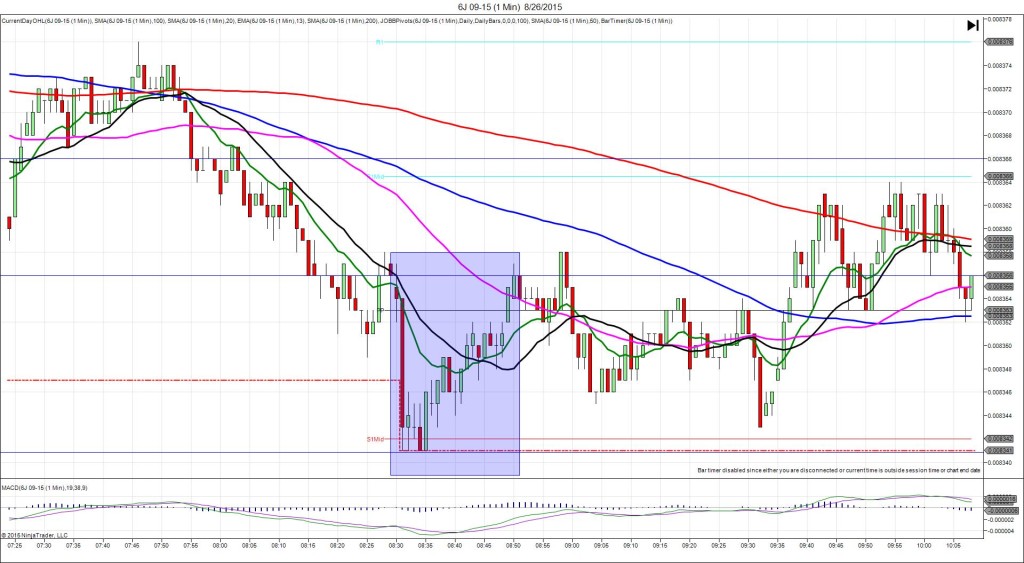

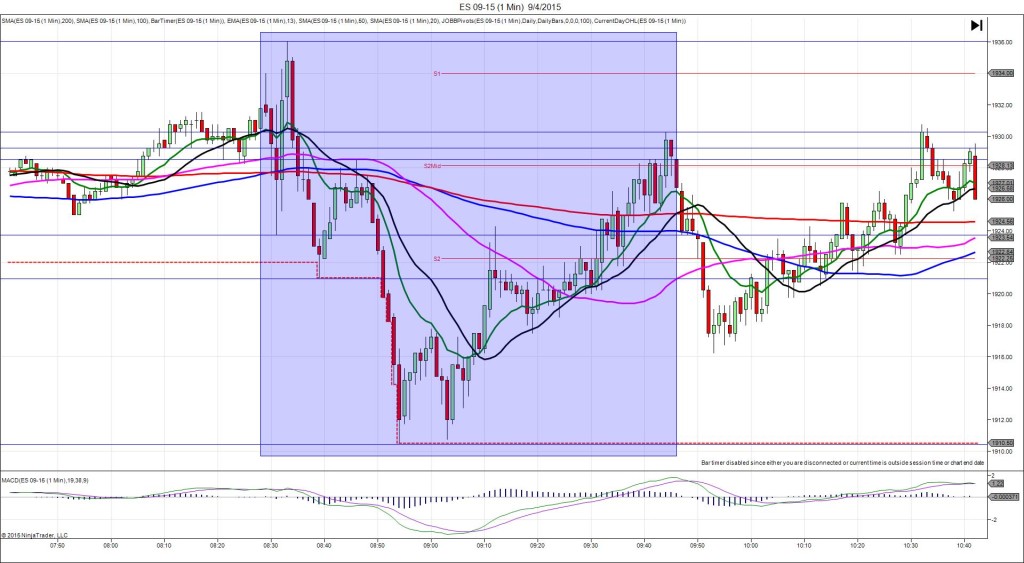

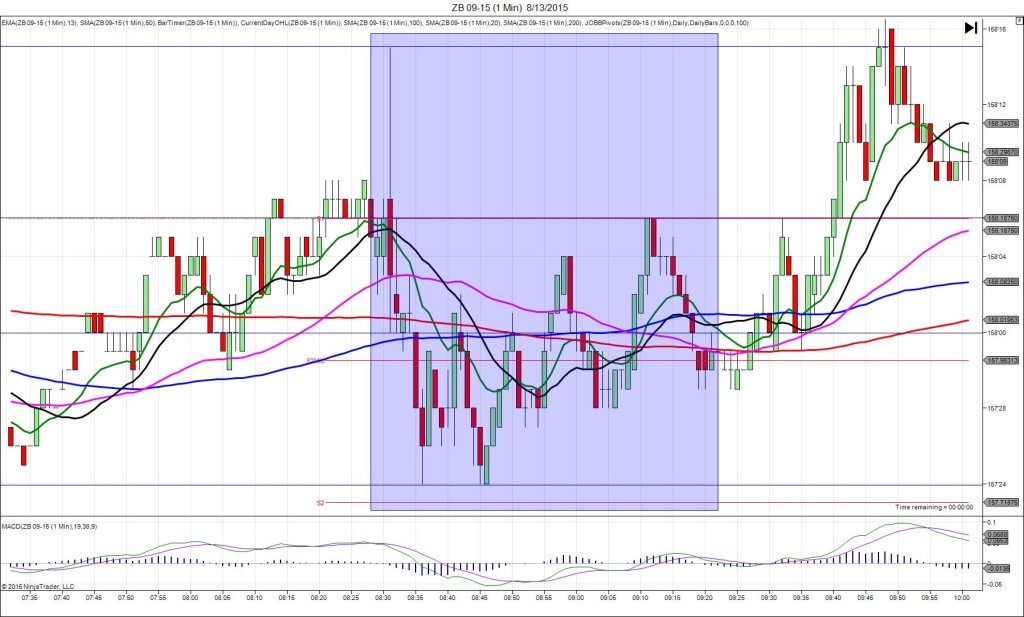

Started @ 0.008052

1st Peak @ 0.008047 – 0830:38 (1 min)

5 ticks

Reversal to 0.008050 – 0833 (3 min)

3 ticks

2nd Peak @ 0.008036 – 0902 (32 min)

16 ticks

Reversal to 0.008043 – 0917 (47 min)

7 ticks

Notes: Report was mixed with the BLDG Permit falling short of the forecast by 0.11M and the Housing starts slightly exceeding the forecast by 0.02M with a moderate upward revision. This caused a short move of 5 ticks that started just above the SMAs and fell to cross the R1 Pivot and 200 SMA. With JOBB and a 3 tick bracket, your short entry would have filled at 0.008049 with no slippage. Then it trickled lower for 2 more ticks to allow an exit with 1-2 ticks of profit. After a small reversal of 3 ticks in 2 min, it fell for a 2nd peak of 11 more ticks in 29 min to the S1 Mid Pivot. Then it reversed 7 ticks in 15 min to the PP Pivot / 50 SMA.