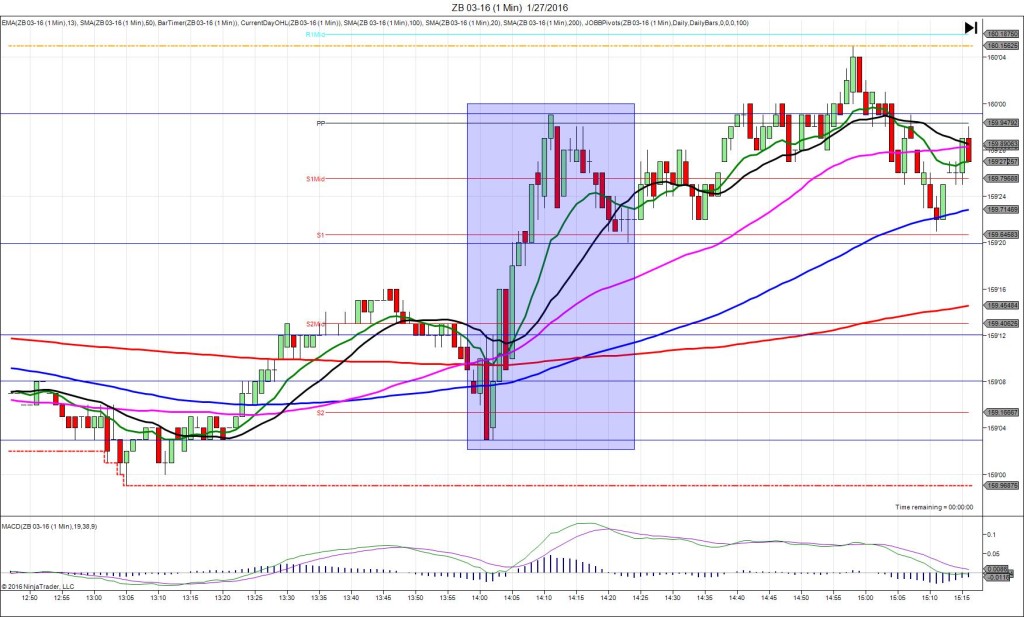

1/27/2016 FOMC Statement / FED Funds Rate (1400 EST)

Forecast: n/a

Actual: n/a

TRAP TRADE – DULL NO FILL

Anchor Point @ 159’08

————

Trap Trade:

)))1st Peak @ 159’03 – 1400:57 (1 min)

)))-5 ticks

)))Reversal to 159’16 – 1402:42 (3 min)

)))13 ticks

————

Pullback to 159’09 – 1404 (4 min)

7 ticks

Reversal to 159’31 – 1411 (11 min)

22 ticks

Pullback to 159’20 – 1423 (23 min)

11 ticks

Trap Trade Bracket setup:

Long entries – 159’00 (just above the LOD) / 158’24 (just below the S3 Mid Pivot)

Short entries – 157’26 (No SMA / Pivot near) / 158’04 (just above the S2 Mid Pivot)

Expected Fill: n/a – cancel

Best Initial Exit: n/a

Recommended Profit Target placement: n/a

Notes: Well, first dull move to not breach the inner tier since last January. It was advisable to cancel the trade on the slow movement and inability to breakout. It fell only 5 ticks in about a minute to eclipse the S2 Pivot, then rallied after that for 10 min to the PP Pivot. Then it fell to the S1 Pivot and 20 SMA.