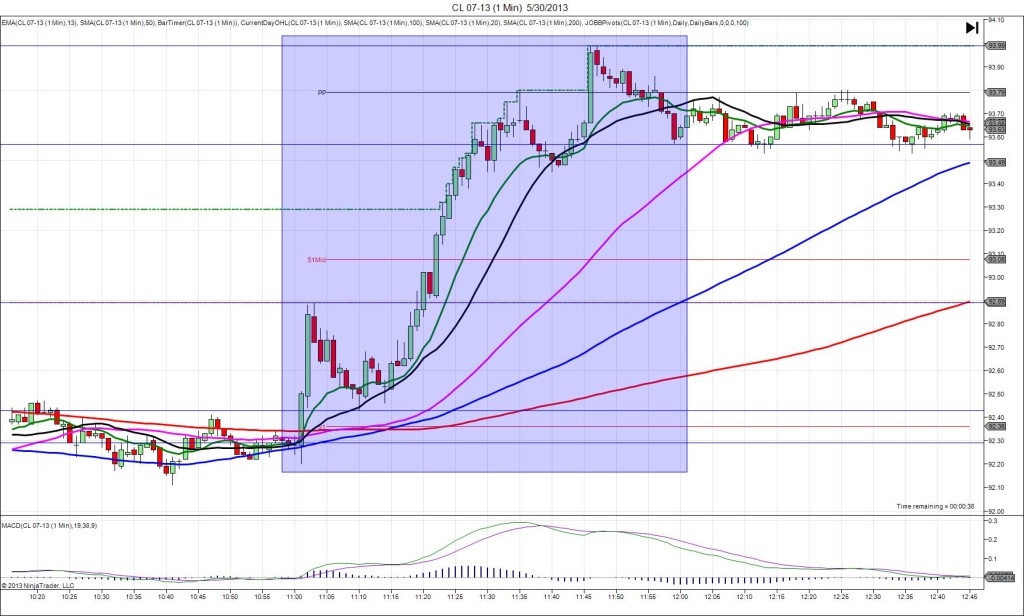

6/12/2013 10-yr Bond Auction (1301 EDT)

Previous: 1.81/2.7

Actual: 2.21/2.5

SPIKE WITH 2ND PEAK

Started @ 139’10 (1301)

1st Peak @ 139’05 – 1302 (1 min)

5 ticks

Reversal to 139’16 – 1303 (2 min)

11 ticks

2nd Peak @ 138’30 – 1319 (18 min)

12 ticks

Reversal to 139’11 – 1341 (40 min)

13 ticks

Notes: Report is scheduled on Forex Factory at the top of the hour, but the spike always breaks 1+ min late. The highest yield rose significantly from the previous auction. This caused the ZB to spike short for a muted 5 ticks as it was stuck on the 200 SMA, then retreat fairly quickly. With JOBB you would fill short at 139’07 with no slippage. I decided to leave the stop loss unchanged at 139’12 with the 200 SMA sitting at 139’10 and acting as resistance, then I was stopped about 30 sec after I was filled as it reversed up to the 100 SMA and R1 Mid Pivot for 11 ticks. Then it left that wick naked and fell again to chop lower for an eventual 2nd peak of 12 ticks after about 18 min, crossing the PP Pivot briefly. Then it popped back up for a final reversal of 11 ticks in about 22 min to reach the intersection of the 100 and 200 SMAs.