3/5/2014 Monthly Retail Sales / Trade Balance (1930 EST)

Rtl Sales

Forecast: 0.5%

Actual: 1.2%

Previous Revision: +0.2% to 0.7%

Trade Bal

Forecast: 0.11B

Actual: 1.43B

Previous Revision: +0.12B to 0.59B

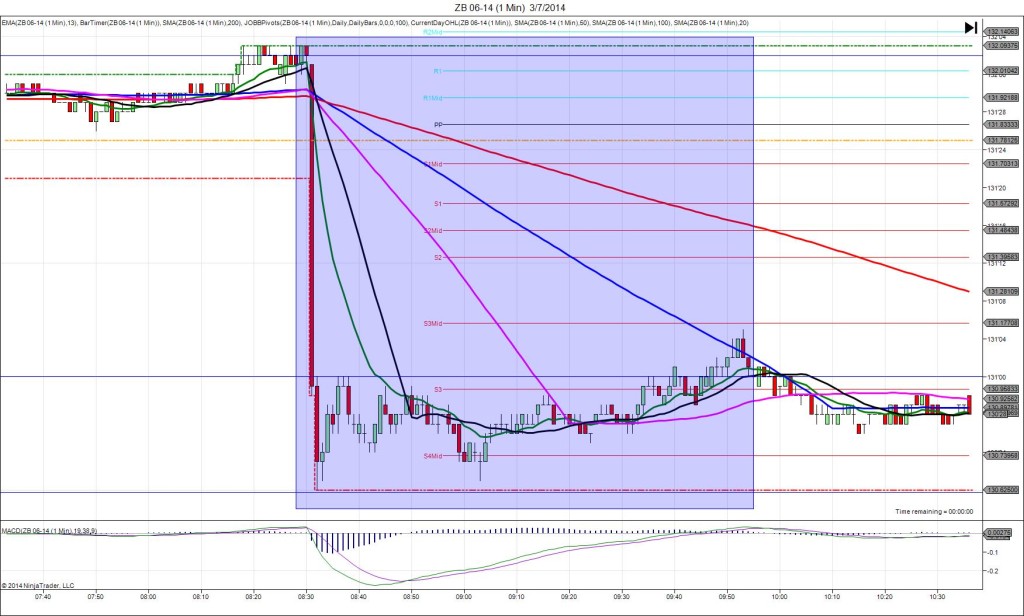

TRAP TRADE (STOPPED OUT)

Anchor Point @ 0.8980 (last price)

————

Trap Trade:

1st Peak @ 0.9023 – 1930:10 (1 min)

43 ticks

Reversal to 0.9008 – 1930:42 (1 min)

-15 ticks

————

2nd Peak @ 0.9028 – 1933

48 ticks

Reversal to 0.9013 – 1948 (18 min)

15 ticks

Trap Trade Bracket setup:

Long entries – 0.8966 (between the LOD and the S1 Mid Pivot) / 0.8956 (just below the S1 Pivot)

Short entries – 0.8997 (just below the R2 Mid Pivot) / 0.9006 (just above the R2 Pivot)

Notes: Retail Sales report had the highest reading and largest offset since April 2013 with a decent upward previous revision, while the Trade Balance report also strongly exceeded the forecast by 1.3B with the highest reading since Feb 2012, coupled with a moderate upward previous report revision. The combination of unusually strong news caused a large decisive bullish spike of 43 ticks that had strong conviction in its climb and sustained the move. Your inner and outer tier short entries would have filled with about a second gap, then you would have been stopped with about 16 ticks with both entries with 1 tick of slippage for a combined 32 tick loss. Though this result was unfortunate, it was a rare extraordinary result and had a low probability of outcome. Still we will adjust the approach to trading combined resports such as this to just use 1 tier in the future to mitigate the risk and hedge the loss. After the peak was reached in 10 sec, it backed off 15 ticks in the next 30 sec, before achieving a 2nd peal of 5 more ticks on the :33 bar as it was flirting with the R3 Mid Pivot. Then it reversed for 15 ticks back to first impact the 13/20 SMAs. When this happens, it is a good place to buy the dip and look to get 10 or so ticks. This would have worked nicely as it achieved a double top about 41 min after the report. Then it traded sideways near the R3 Mid Pivot as volume dried up.