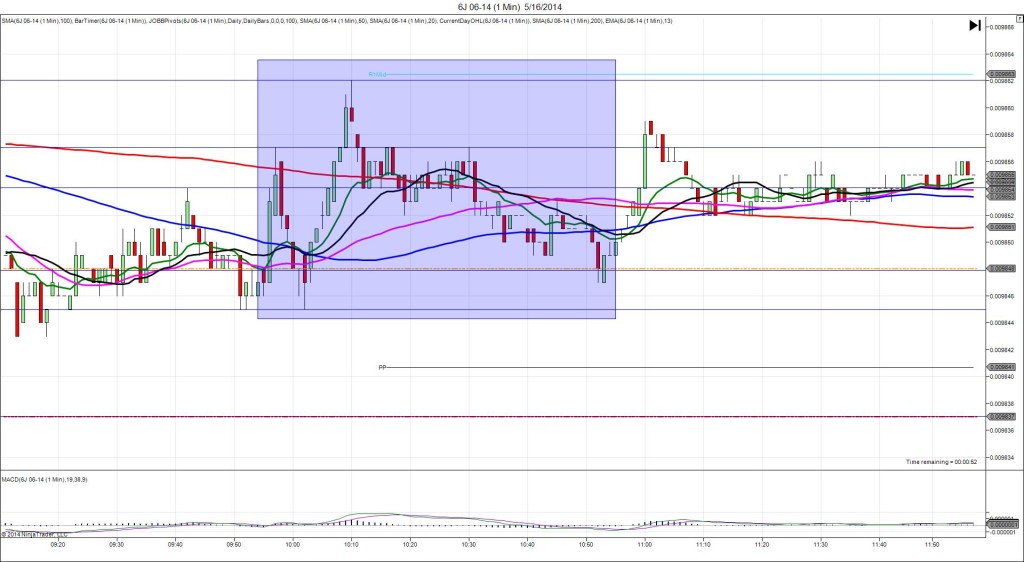

5/16/2014 Monthly Building Permits / Housing Starts (0830 EDT)

Building Permits

Forecast: 1.01M

Actual: 1.08M

Previous revision: +0.01M to 1.00M

Housing Starts

Forecast: 0.98M

Actual: 1.07M

Previous revision: n/a

SPIKE WITH 2ND PEAK

Started @ 0.009860

1st Peak @ 0.009849 – 0831 (1 min)

11 ticks

Reversal to 0.009860 – 0832 (2 min)

11 ticks

2nd Peak @ 0.009837 – 0841 (11 min)

23 ticks

Reversal to 0.009853 – 0901 (31 min)

16 ticks

Notes: Report was strongly impressive overall with the BLDG Permits and the Housing starts greatly exceeding the forecast. This caused a 11 tick short move that started on the 50 SMA then fell to cross the 200 SMA and nearly reach the OOD in about 2 sec. With JOBB, you would have filled short at 0.009855 with 2 ticks of slippage, then seen it fall to hover between 52 and 49 for the first 8 sec for an ideal quick exit of about 4-5 ticks. You would have had another opportunity to exit with about 3 ticks later in the bar or be patient and wait for the 2nd peak with the strong reaction. After the reversal on the :32 bar returned to the origin, it fell for a 2nd peak of 12 more ticks to cross the PP Pivot and extend the LOD in 8 min. Then it reversed for 16 ticks in the next 20 min to the 50 SMA.