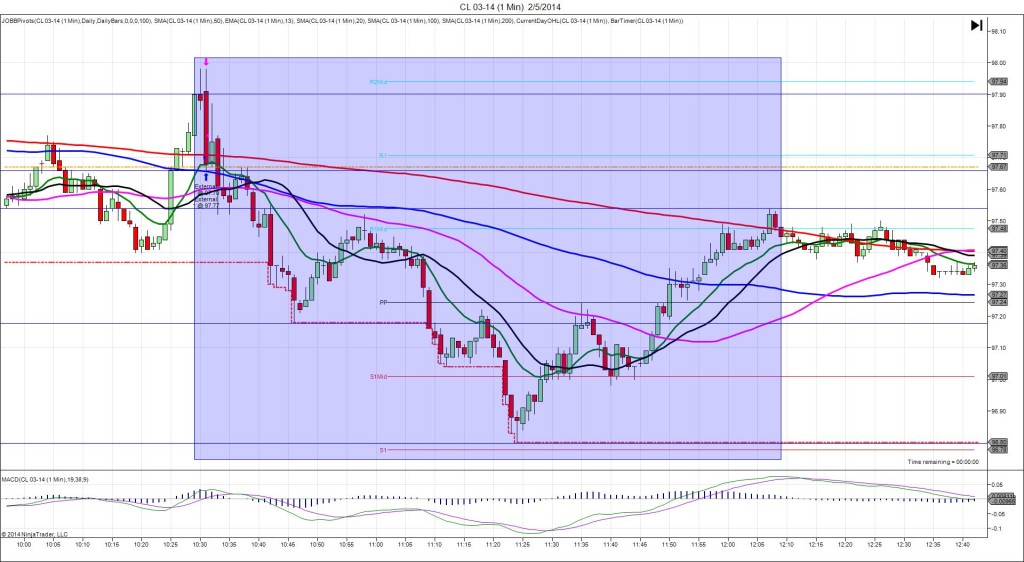

2/7/2014 Monthly Unemployment Report (0830 EST)

Non Farm Jobs Forecast: 185K

Non Farm Jobs Actual: 113K

Previous Revision: +1K to 75K

Rate Forecast: 6.7%

Rate Actual: 6.6%

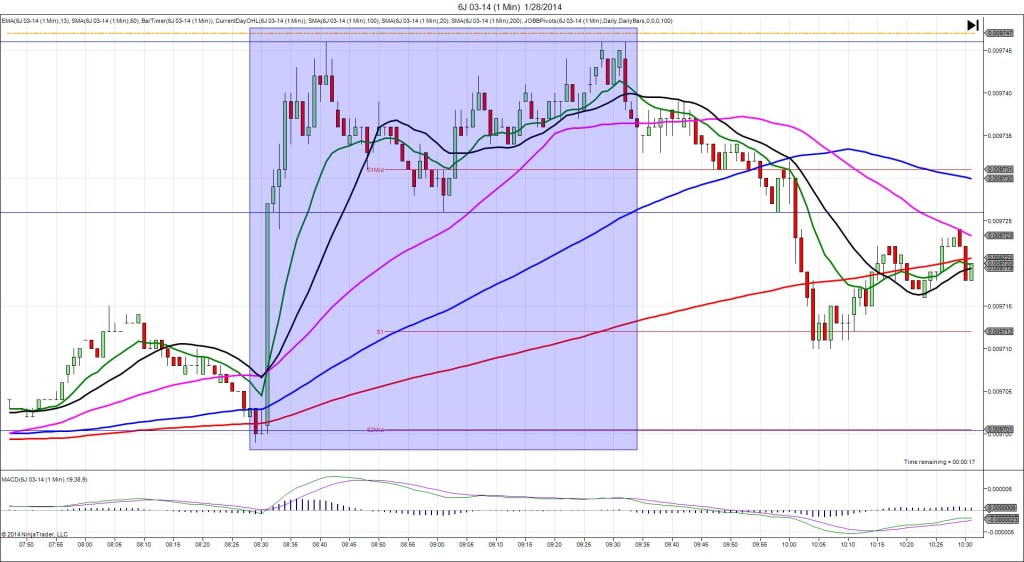

INDECISIVE…SPIKE / REVERSE

Started @ 132’31

Premature spike @ 132’12 – 0830:59 (0 min)

19 ticks

1st Peak @ 134’02 – 0832 (2 min)

54 ticks

Reversal to 132’29 – 0930 (60 min)

37 ticks

Notes: Disappointing report showing 72K less jobs created than expected, a negligible previous upward revision of 1K jobs, and a 0.1% improvement in the unemployment U-3 rate as retailers and government agencies cut payrolls, while construction and manufacturing grew. This caused a premature short move of 19 ticks at 59 sec that promptly reversed after the about 2 sec. It fell to cross the S2 Pivot, then reversed to cross all 3 major SMAs and the R2 Pivot for 54 ticks. With JOBB, you would have filled short at about 132’19 with abnormally high 8 ticks of slippage, then been stopped at about 132’26 with variable slippage added to the 5 tick loss between 0 and 5 ticks depending upon broker, feed, and VPS. After the peak, it reversed steadily for 37 ticks in the next hour, crossing all 3 major SMAs and reaching the S1 Mid Pivot. Then it bounced off of the low and trended slightly higher, but unable to break through the 133’19 area.