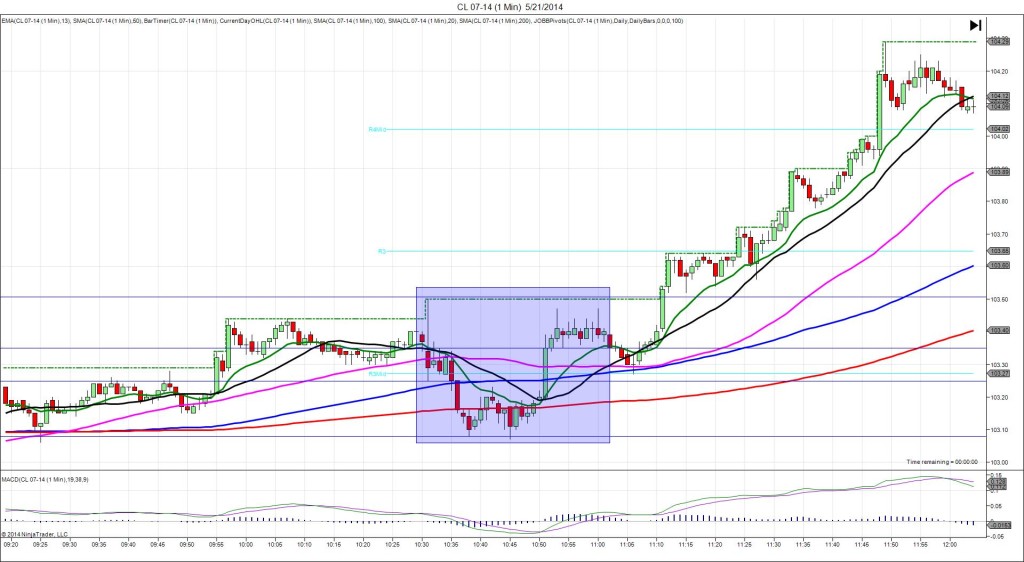

5/21/2014 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: 0.75M

Actual: -7.23M

Gasoline

Forecast: 0.08M

Actual: 0.97M

Distillates

Forecast: -0.29M

Actual: 3.40M

INDECISIVE

Started @ 103.35

1st Peak @ 103.25 – 1030:02 (1 min)

-10 ticks

Reversal to 103.50 – 1030:21 (1 min)

25 ticks

2nd Peak @ 103.08 – 1038 (8 min)

27 ticks

Reversal to 103.47 – 1053 (23 min)

25 ticks

Notes: Large draw in inventories when a negligible gain was expected, while gasoline saw a negligible gain when no change was expected, and distillates saw a moderate gain when a negligible draw was expected. The news was conflicting, and the large draw on the crude with the healthy gain on the distillates caused indecision. This resulted in a 10 tick short spike that fell to cross the 50 SMA and the R3 Mid Pivot, then a reversal of 25 ticks that extended the HOD. With JOBB and a 10 tick buffer, you would filled short at 103.25 with no slippage at the bottom of the short move, then unless you were quickly your stop would have taken you out for 15 ticks with no slippage 7 sec later. Then it fell for a 2nd peak of 17 more ticks to cross the 200 SMA after 7 min. After that it reversed for 39 ticks to nearly reach the HOD in the next 15 min. It continued to step higher for nearly 100 ticks in the next hour as the large draw on the crude sunk in.