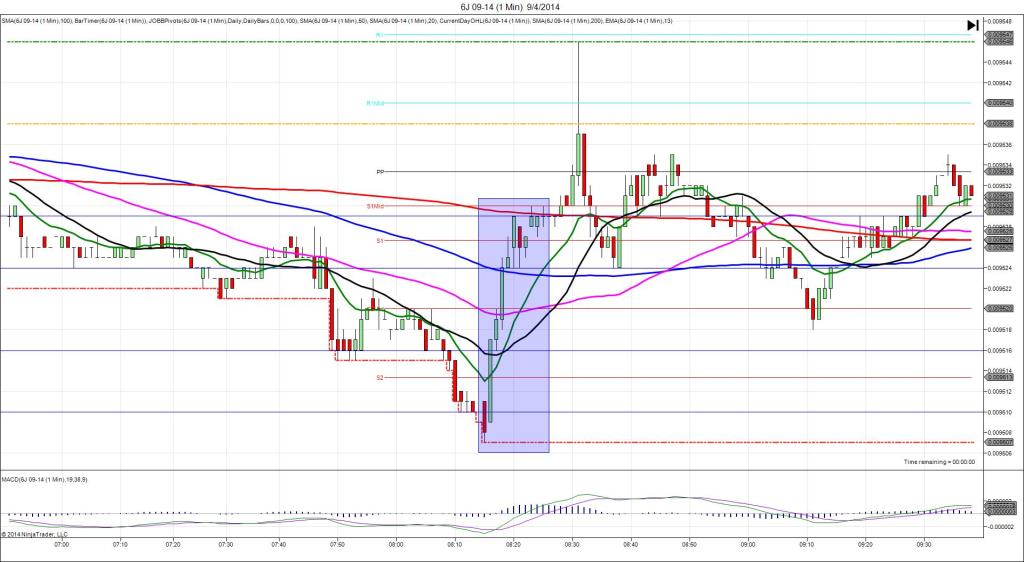

9/4/2014 Weekly Crude Oil Inventory Report (1100 EDT)

Forecast: -1.11M

Actual: -0.91M

Gasoline

Forecast: -1.33M

Actual: -2.32M

Distillates

Forecast: -0.50M

Actual: 0.61M

SPIKE / REVERSE

Started @ 94.97

1st Peak @ 95.28 – 1100:00 (1 min)

31 ticks

Reversal to 94.62 – 1108 (8 min)

56 ticks

Pullback to 94.99 – 1124 (24 min)

37 ticks

Reversal to 94.33 – 1137 (37 min)

66 ticks

Notes: Negligible draw in inventories when a slightly greater draw was expected, while gasoline saw a moderate draw when a modest draw was expected, and distillates saw a negligible gain when a negligible draw was expected. This caused a shortly sustained long spike of 31 ticks that started above the 100 SMA and rose to cross the PP Pivot and OOD in the first sec. It quickly backed off and hovered about halfway up the spike. With JOBB and a 10 tick buffer, you would have been filled long at about 95.12 with 5 ticks of slippage, then seen it briefly show 16 ticks of profit before retreating to chop around the fill point for 40 sec. It spent most of the time in the green, so look to exit with 2-5 ticks. The reversal took over and fell 56 ticks to the S1 Mid Pivot in 7 min. Then it pulled back 37 ticks in the next 16 min to the 100 SMA. After that it reversed for 66 ticks in 13 min, but could not reach the S1 Pivot.