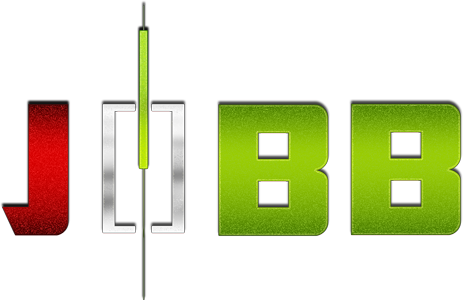

8/20/2014 FOMC Meeting Minutes (1400 EST)

Previous: n/a

Actual: n/a

TRAP TRADE – INNER TIER (SPIKE WITH 2ND PEAK)

Anchor Point @ 139’26

————

Trap Trade:

)))1st Peak @ 139’18 – 1400:08 (1 min)

)))-8 ticks

)))Reversal to 139’26 – 1400:54 (1 min)

)))8 ticks

)))Pullback to 139’18 – 1401:49 (2 min)

)))-8 ticks

)))Reversal to 139’23 – 1403:00 (3 min)

)))5 ticks

————

Final Peak @ 139’11 – 1423 (23 min)

15 ticks

Reversal to 139’23 – 1500 (60 min)

12 ticks

Trap Trade Bracket setup:

Long entries – 139’21 (just below the 50 SMA) / 139’17 (just below the LOD)

Short entries – 139’31 (No SMA / Pivot near) / 140’03 (just above the HOD)

Notes: With tapering down to $25B and perceived 2 more steps to end QE3, the minutes revealed that the FED was closer to consensus on an exit strategy and may end stimulus sooner than expected. This caused a large short reaction of 8 ticks that started just above the S1 Mid Pivot and fell to reach the LOD, then quickly reversed back to the origin. This would have filled your inner long entry at 139’21, then fallen another 3 ticks to fall 1 tick short of the outer tier. Then it reversed 8 ticks back to the origin in the next 46 sec. It hovered between 139’25 and 139’26 to allow an exit with 4-5 ticks. Be sure to exit quickly on FED trades after an opportunity when it reverses near the origin. It fell for a double bottom 1 min later, then reversed 5 ticks to the 200 SMA. Then it stepped lower for a final peak of 7 more ticks, crossing the S1 Pivot. Then it reversed for 12 ticks in the next 37 min as it crossed the 200 SMA.