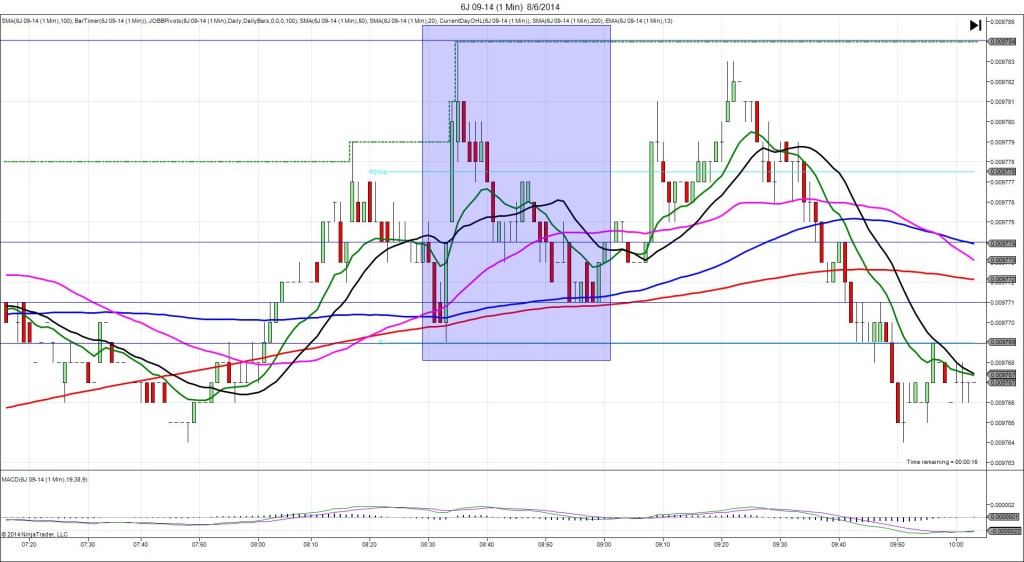

8/1/2014 Monthly Unemployment Report (0830 EDT)

Non Farm Jobs Forecast: 231K

Non Farm Jobs Actual: 209K

Previous Revision: +10K to 298K

Rate Forecast: 6.1%

Rate Actual: 6.2%

TRAP TRADE – TIER 2 (SPIKE WITH 2ND PEAK)

Anchor Point @ 1913.25 (last price)

————

Trap Trade:

)))1st Peak @ 1922.00 – 0830:18 (1 min)

)))35 ticks

)))Reversal to 1919.50 – 0830:26 (1 min)

)))-10 ticks

)))Pullback to 1925.00 – 0830:45 (1 min)

)))22 ticks

)))Reversal to 1918.00 – 0831:34 (2 min)

)))28 ticks

————

2nd Peak @ 1926.75 – 0849 (19 min)

54 ticks

Reversal to 1918.00 – 0918 (48 min)

35 ticks

Trap Trade Bracket setup:

Long entries – 1907.00 (No SMA/ Pivot near) / 1903.25 (No SMA / Pivot near)

Short entries – 1919.50 (No SMA / Pivot near) / 1923.75 (No SMA / Pivot near)

Notes: Moderately negative report with 22K less jobs added than the forecast, a small upward revision to the previous report and an uptick of 0.1% in the U-3 rate. We saw a long spike of 35 ticks in the first 18 sec then a brief reversal followed by another push for 12 more ticks after 45 sec. This would have filled the inner short tier on initial burst, then the outer tier on the next move. With an average short position of 1921.75, look to exit at about 1919.50 for 17 total ticks. After that it climbed for a 2nd peak of 7 more ticks after 19 min, then it reversed 35 ticks in the next 29 min to the 100 SMA.