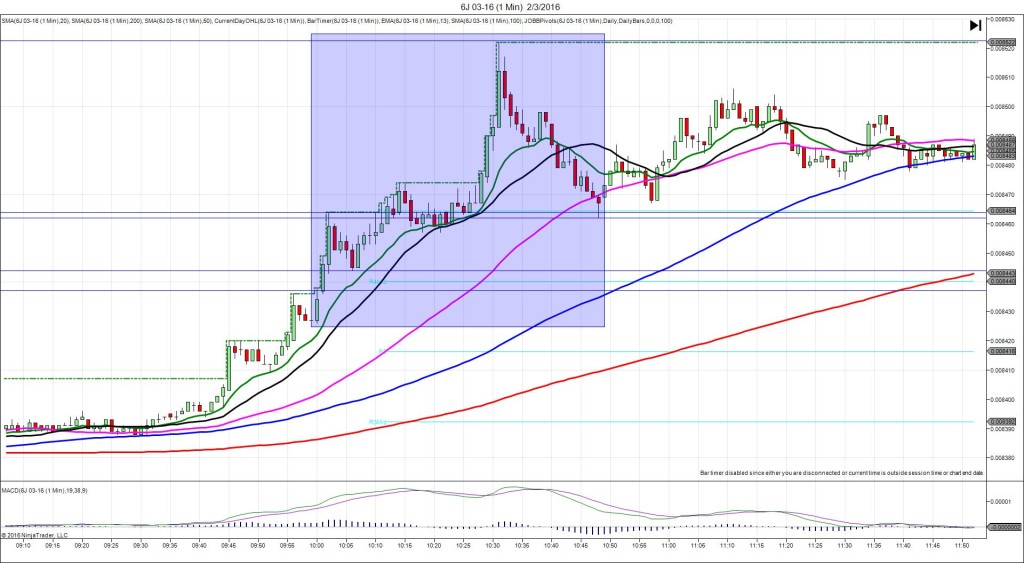

2/3/2016 Monthly ISM Non-Manufacturing PMI (1000 EST)

Forecast: 55.1

Actual: 53.5

Previous Revision: n/a

SPIKE WITH 2ND PEAK

Started @ 0.008436

1st Peak @ 0.008464 – 1001:50 (1 min)

28 ticks

Reversal to 0.008444 – 1006 (6 min)

20 ticks

Final Peak @ 0.008522 – 1031 (31 min)

86 ticks

Reversal to 0.008462 – 1048 (48 min)

60 ticks

Expected Fill: 0.008439 (long)

Slippage: 0 ticks

Best Initial Exit: 0.008463 – 24 ticks

Recommended Profit Target placement: 0.008452 (in between the R4 / R4 Mid Pivots)

Notes: Bullish report was assisted by a strong uptrend in the market to deliver a large 1st and final peak. The 1st peak reached the R4 Pivot, then once breached, no resistance barrier is left. Due to the large move from 1028 – 1031, it reversed strongly.