4/3/2013 Monthly ISM Non-Manufacturing PMI (1000 EDT)

Forecast: 55.9

Actual: 54.4

Previous Revision: n/a

SPIKE WITH 2ND PEAK

Started @ 96.68

1st Peak @ 96.39 – 1006 (6 min)

29 ticks

Reversal to 96.55 – 1027 (78 min)

16 ticks

2nd Peak @ 96.08 – 1038 (38 min)

60 ticks

Reversal to 96.46 – 1055 (55 min)

38 ticks

Notes: Moderately negative report fell short of the forecast by 1.5 points. This caused a slow developing short spike of 29 ticks that culminated on the :06 bar. It used the 100 and 200 SMAs as resistance for the launch. With JOBB, you would have filled short at 96.64 with no slippage, then had an opportunity to exit with 6-20 ticks on the :02-:06 bars depending upon your patience. After the initial peak it chopped sideways and eventually reversed to nick the 50 SMA. Then it fell for a dramatic 2nd peak of 60 ticks after a brief struggle with the S1 Pivot. Then the reversal reclaimed 38 ticks, crossing the S1 Pivot and eclipsing the 50 SMA. After that the selloff continued to 94.18 until the pit close at 1430, about 3.5 hrs later, but not due to this report.

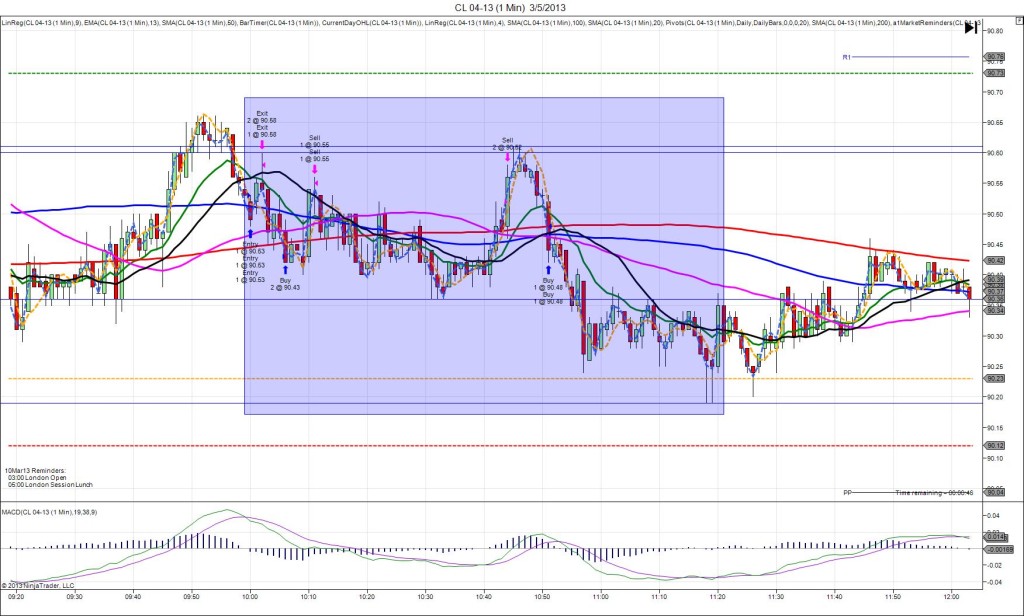

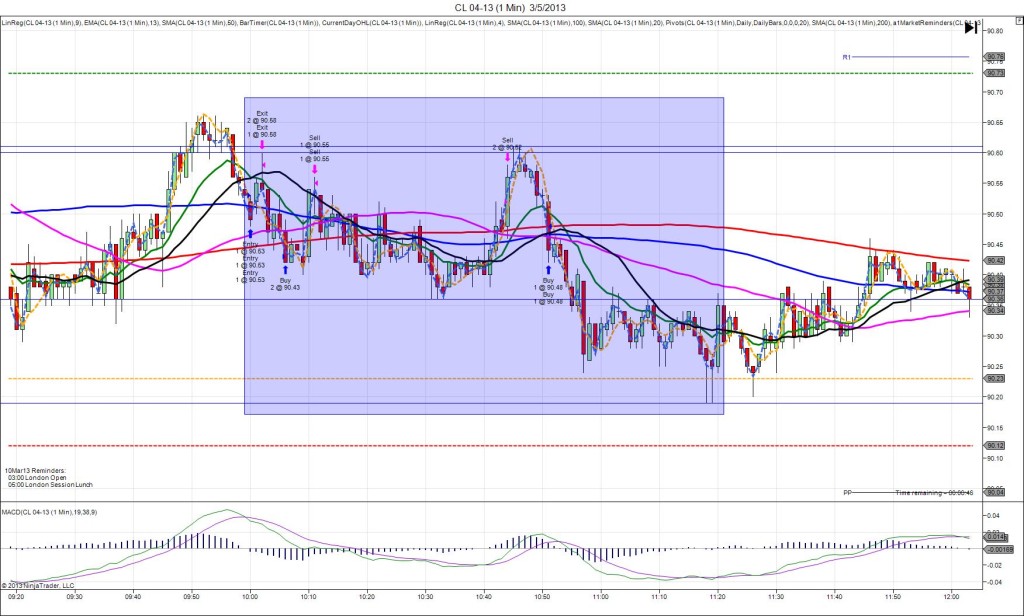

CL 04 13 (1 Min) 3.5.2013

3/5/2013 Monthly ISM Non-Manufacturing PMI (1000 EST)

Forecast: 55.0

Actual: 56.0

Previous Revision: n/a

SPIKE/REVERSE

Started @ 90.49

1st Peak @ 90.60 – 1002 (2 min)

11 ticks

Reversal to 90.19 – 1118 (78 min)

41 ticks

Notes: Moderately positive report exceeded the forecast by a point. This caused a small long spike of 12 ticks that was unsustainable and could not reach the short term high attained a few min before the report. It used the 100 SMA as support for the launch, then the 20 SMA was enough resistance to rein it in. With JOBB, you would have filled long at 90.53 with no slippage, then had an opportunity to exit with 3-6 ticks on the :02 bar at or above the 20 SMA. After that it chopped sideways stuck in the fist of SMAs and attempted a 2nd peak, only able to achieve 1 more tick. Then the reversal fell 41 ticks to cross the all 3 SMAs and find support at the OOD.